prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

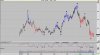

LOL your analysis is as good as mine OWG.

"We could go up, or we could go down" Thats my kinda thinking, but i dont need letters and numbers to say that

Thats my kinda thinking, but i dont need letters and numbers to say that

"We could go up, or we could go down"