Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

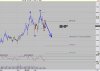

I nearly went short on WPL on a whim on Friday at close (due to rapid increase of price in short time), then analyzed last night and noticed an exhaustion gap.

Then, nearly went long on it today at close.

Should be interesting to see how it goes. Either way, good luck tech/a!

Short man... go short, to about 43... or at least 52/3 initially.