- Joined

- 21 April 2005

- Posts

- 3,922

- Reactions

- 5

Snake.

Ive used BHP.

My overall analysis of the market is at this point bearish.

As such I'm looking for a direction after this period of whipsawing finishes.

The market "looks" as if it has no idea wether it wants to continue down or resume up.

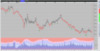

This VSA chart shows this whipsawing in the XJO the blue trend indicators are all over the place.

Note the really high volumes in the light pink area preceed good moves.

Nothing for us YET on any capitulation of this moves so I'm still bearish over all.

BHP isnt displaying the higher lows and highs assoviated with a change in trend.

More so a corrective move into this wave 4. Its been alerted by AGET that this is what it thinks this move is. At this point I have no reason to doubt this.

So I'm looking for a place to take this short position.

Stochastic is close as are points given to me by other analysis.

Finally BHP's VSA chart.

Yesterdays very tight range reasonable volume bar indicates selling.

Id expect to see higher volume on rises from here--possibly with weakness shown in the bar.

IE closing off its highs.

Will keep this going if interested.

Will be proven right or wrong eventually.

Thanks for the effort Tech.

It is interesting to see two different software packages in the analysis not to mention boggo's Mt predictor.