- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

The Plight of the Transports

Friday, September 21, 2012 at 05:14PM

http://www.bespokeinvest.com/thinkbig/2012/9/21/the-plight-of-the-transports.html

Friday, September 21, 2012 at 05:14PM

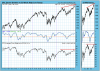

One of the more noteworthy market trends over the past couple of months has been the relative underperformance of the Dow Jones Transportation Index. After a devastating few days that saw both FedEx (FDX) and Norfolk Southern (NSC) collapse on negative guidance, the Transports fell nearly 6% this week. At the same time, the Dow Jones Industrial Average (DJIA) only fell a few points. Below is a chart comparing the performance of the Transports and the Dow over the last six months. The huge divergence between the two over the last couple of weeks stands out.

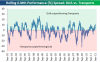

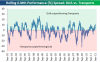

Over the last six months, the Dow (DJIA) is up 3.47%, while the Transports are down 7.90%. While wide, the 6-month spread in performance between the two is not out of the ordinary, as shown in the chart below. At the same time, peaks and troughs in the performance spread have not really been bullish or bearish for the future direction of the overall market either. While the spread could widen more, it's likely that we'll see a reversal in the relative underperformance of the Transports in the near future, but that doesn't mean the Dow is doomed.

http://www.bespokeinvest.com/thinkbig/2012/9/21/the-plight-of-the-transports.html