- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

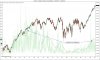

Re: S&P Analysis

Second uptake of LTRO tonight along with Bernanke testimony.

Could really explode tonight, watch for it......

Second uptake of LTRO tonight along with Bernanke testimony.

Could really explode tonight, watch for it......