I can't help you with price targets I've never used them in my trading, I'm not smart enough to know when a stock will stop going up, thats why I use trailing stops.

Their Primary purpose is another reason to take one trade over another

We hopefully have more trades to take than funds to take them with

and If We over diversify We maybe lose focus and retreat to a mkt average

return...

As the move unfolds they are ( How ever determined ) a way of judging

the relative strength of one trade Vs another and provide stop look and listen points ..

eg In the BPT chart I posted when price reached the vicinity of the downside target. would You automatically close the short ? No.

But when the climatic stopping action appeared as well ? Yes..

An active exit frees up funds for another entry with better R/R at that time

The R/R of an existing position deteriorates as the move progresses

R/R means defining risk and having some conception of reward

What is important is time frame and opportunity cost..

rather than eking out a few last points of profit..

...........

TAH

Some positive signs to that chart

On the last BAR.... Even individual BARS represent waves of Buying and selling

that attract and gather followings

Demand was the winner and Volume shows a larger following

What does that tell Us about the following on the supply side ?

From the top supply has been overcomimg demand

But the price action found support ( some good indicative BARS show demand ,Vol off the bottom ) and demand and supply have come into equilibrium as the bars have moved across the trend channel

forming your triangle

What does the last BAR say about the the balance between demand and supply NOW ?

But Do We need more evidence , After every thrust there is the reaction

Have We had any higher lows ?

too early ?

.........................

MXI... low volume but ...

The last BAR has very good range and close

in this case with demand reaching so Far what does it suggest the low volume

is caused by ?

The last 6 BARS tell a nice story.. They took out some suggested resistance

Do We wait for a backup ? Should We wait for the a selling wave to see

If there is no longer any following at these prices ?

..........................

HVN there was nice volume in the rally then volume did fall in the reaction

but just Now... Does it look a little tired ?

............................

The trend of the market is so important

What sectors are building strength and weakness ?

As I slowly (very slowly) begin to understand some of what you're saying it's slowly changing the way I look at the market and the way I trade. I definately need more patience waiting for the tade to come to me.

There will always be opportunity... The key is Not losing money while the standout opportunities arrive...

If the mkt breaks out with vigor into a new leg of the bull mkt

How easy then ? Even second rate plays will make money ..

But If price reacts back down to the bottom of the current trend channel

Well taking longs is like pushing string...

it can be done, But.............

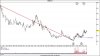

P&F is worth looking into

it aggregates all the waves of action

and does not have a fixed time scale

Bar/candle charts cut the swings of the (market )pendulum into discrete periods of time

P&F charts cut time into discrete swings of the (market) pendulum.

One column may be 3 bars because they are really one bar

the next column in the other direction may be 6 bars because they are really one bar.

Then because of the filter the next 10 bars are ignored because they are really nothing...

Now You could make a bar chart that changed it's time frame as the trends and speed of the trends changed (very hard ).Or You could have a chart that automatically adapted to the action because it was price and not time driven ..

On the bar chart you would have 19 bars across

On the P&F chart You would have three columns

sometimes it could be the other way around ( That is only with a pure P&F ).

The main difficulty has been the trend and position in that trend of the Market... It is the great tide that all the individual opportunities are treading water in...

As I wright this the DOW is up over 100 points

One thing the range is building is a cause

We get a breakout

It should propel many longs into good trades..

Do We see any change of behavior with the last two bars ?

motorway