- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 391

I meant LYL not LYC!!

I haven't overlaid the iron ore price chart over the MND share price chart, but I suspect that the renewed weakness in the share price as coincided with the fall in the iron ore price. Although MND has spent some time diversifying away from supporting iron ore miners into the energy sector, it seems the market still perceives MND as a supplier to iron ore miners and is marking MND down accordingly.

From their full year presentation, iron ore was 35% of their revenue. Iron ore has plunged recently but coal hasn't been having much fun for even longer, and that's 16.8% of their revenue.

If you read the report by any of it's peers, everyone is trying to diversify into oil and gas. The oil and gas industry is currently propped up by the last stage of the LNG building spree and the related CSG areas. Be prepared for much lower revenue and profits when that segment comes off the boil.

Just curious, and of course you don't have to answer, but how far would it have to fall before you'd get out?Down 3% in a market that fell about 1% today.

The share price chart looks very poor and I'm deep into the red, but I'm continuing to hold

Down 3% in a market that fell about 1% today.

The share price chart looks very poor and I'm deep into the red, but I'm continuing to hold

Down another 2.6% today. I'd forgotten all about this thread but note McCoy Pauley in September said

I wonder if he's still holding?

Yep, still holding. The industry is S-T-ruggling, of that there is no question, but management don't appear to be disclosing any adverse issues which would make me change my mind at this stage about holding shares in MND, as I rate MND the best operator in the industry. I'm participating in the DRP so add to my holdings every six months but otherwise not adding to my holding.

MND seems to be doing a reasonable job at diversifying into the oil & gas sector, but it would be nice if their contract wins were a little higher than $90 million from time to time!

Pure speculation but the slide in the iron ore price of late and the general perception that MND is primarily an engineering services company to the iron ore sector is working against sentiment in MND.

The entire sector has been trashed out of fear of falling commodity prices. There's some value to be had, but McLovin's comments around the industry not being anywhere near the bottom concerns me. I'd rather sit it out than go contrary to his view.

BYL is probably most attractive at the moment, given the order book they have. Although their cap raising was a train-wreck.

@McCoy Pauley - are you aware of the order book amounts beyond FY15 for MND?

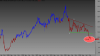

From a technical view and knowing the future outlook is for slower growth I have gone to the Bulkowski well for a price target on the Descending Triangle formation. Thomas states that you deduct the formation high at the start from the formation low at the start, multiply this by the sample success rate hitting target and deduct that from the breakout price. So the calc. is

A $20.82 - B $15.20 = $5.62

$5.62 * sample success rate 0.54 = $3.03

Deduct $3.03 from breakout price $14.49 = $11.46

C = $11.46 target price

Today's low was $11.40 and close price was $11.49

From a personal perspective, simply recording these observations.

View attachment 60218

Don't know and never do! Technically it has collapsed which I took advantage of today @ $10.43 for 400 shares, again at a technical level. To add confidence, by day end the price had extended back up to form a hammer candle. This means that there could be a short-medium term trend change as supply is exhausted. The U.S. markets can correct at anytime and our market may retreat further so the pressure to close out a position may return. React to market conditions/price action and use what you know (or think you know).Technically now this has broken down again where is it heading now?

Today Deutsche Bank upgraded Monadelphous to a ‘hold’ on valuation grounds and has a target price of $11.43 a share on the mining services group.

Things are different and the overall market has weighed upon MND which I escaped at break even after brokerage. Overwhelming resistance. Must stop playing the buy low, sell lower game.Not a common practice to buy in such a strong downward momentum and things could be very different.

There are still stocks that are going up in the present market, or at the very least, not showing the determined and pronounced downtrend of MND. It has been trading below the EMA since July.Things are different and the overall market has weighed upon MND

Am holding up trenders at the moment.There are still stocks that are going up in the present market, or at the very least, not showing the determined and pronounced downtrend of MND.

Have not made any losses on MND and my approach is to cut these down trenders if they slip further, there is stubborn resistance and/or Index movement is negative. No emotional attachment.I'm just curious, and certainly there's no obligation for you or anyone else to respond, but is there a point at which the losses will be unacceptable, or is it a case of "too late now to sell"? Or "I believe in this stock, am emotionally invested in it, so will find any point that will allow me to rationalise holding."

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.