- Joined

- 13 February 2006

- Posts

- 5,387

- Reactions

- 12,516

Ah, may I have the fish without chips? NIce list and worth monitoring for reversal opps.

Just a thought. Could the recent high (SPY) and the very recent tech low (QQQ), when it's found, be the delimiters for a long trading range in the US markets? Long as in one to two years.

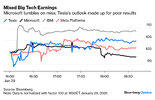

Investors will have to reassess their market expectations in light of DeepSeek's claims along with the huge PEs. The current news presents a good opportunity for a pause in the bullish sentiment.

On FCX from your thread, $36.02 is a buy currently. Added.

SPY: next support I have is 575

Limits for next 1-2yrs. I have no idea.

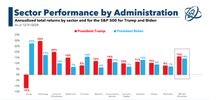

But clearly the SPY reached its most recent high with a lot of help from Mag 7 and NVDA in particular. If tech. as a sector is now struggling, the SPY could well struggle to break through that recent high.

Which means either (i) churn or (ii) we turn lower. I think (ii) because of the debt overhang.

Although, in March 2000 NASDAQ blew up, SPY went higher for another year. But at that time (check on this) the tech. exposure was much lower than it was currently.

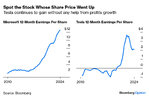

- Nvidia ($NVDA) had its worst day since March 2020 today, dropping -17%. Its market cap shed -$600 billion, making Apple ($AAPL) the largest stock in the S&P 500 again.

- Ian points out that $NVDA violated its 200-day moving average for the first time in two years, closing slightly below it. More importantly, the trend remains higher.

- They say, "Nothing good happens below the 200-day moving average," but reclaiming it could spark a bullish reversal given the sudden shift in sentiment.

The Nasdaq is down well over 3% as of this writing with AI hardware names driving the declines. The main AI infrastructure stock -- NVIDIA (NVDA) -- is down roughly 20% over the last two trading days, which equates to a drop of nearly $700 billion in market cap! Amazingly, news that DeepSeek out of China had built a ChatGPT-like product for a fraction of the cost was actually circulating weeks ago at the end of last year. It wasn't until this weekend, though, that the ramifications of this news started being debated heavily on social media platforms like X.

Our AI Basket is a set of 50 stocks with exposure to the AI Boom. The headline basket is further broken down into two sub-baskets: the Infrastructure basket and the Implementation basket. The former is comprised of stocks whose hardware and software lay the foundation for AI to work. These include companies that make semiconductors, data centers, cloud storage, and more. The Implementation basket, on the other hand, is made up of companies whose products are more oriented towards end-users of AI. This includes stocks with products like AI augmented software, copilots, automated services and the like.

Although AI stocks are down broadly today, it is the Infrastructure basket that has been hit the hardest. With DeepSeek's supposed low-cost to build its latest ChatGPT-like offering, it has brought into question the necessity for massive capex spend on chips and datacenters, and our AI Infrastructure sub-basket is down an incredible 8.2% on the day as a result! That compares to only a 1.5% decline in our Implementation sub-basket. As shown below, since the start of our AI Baskets a little over two years ago, this is easily the worst day for our Infrastructure basket relative to our Implementation basket to date, and it isn't even close. In tonight's Closer, we will provide a further look into the performance of the AI baskets in the wake of the DeepSeek discussion.

Obviously yesterday generated:

Those dates...a concern?

Oil News:

The ramifications of the Biden administration’s sanctions on Russia’s shadow fleet continue to roil oil markets, with the Brent-Dubai spread traded on ICE Futures expanding to its widest since at least 2015.

- The Middle East’s Dubai medium sour benchmark traditionally trades at a discount to Brent, but panic buying from Indian and Chinese refiners sent it to a $2.1 per barrel premium over the global benchmark.

- Asian refiners prefer prompt cargoes that are set to load over the upcoming weeks to avoid any shortfalls in crude deliveries, with frantic purchases putting Dubai’s average daily traded volume this month to 56,000 contracts, the highest on record.

- As Dubai-pegged grades become too expensive, Chinese refiners have almost doubled their purchases of Brazilian crude, buying almost 800,000 b/d for April, whilst India’s spot tenders have seen state-owned refiners like IOC doubling down on West African sweet barrels from Nigeria and Angola.

Market Movers

- US oil major ExxonMobil (NYSE:XOM) started exploratory drilling its Electra prospect in offshore Cyprus, previously describing the area west of the island as ‘highly promising’ despite it being the first ever wildcat in Block 5.

- US oil and gas firm ConocoPhillips (NYSE:COP) has taken over the Kebabangan cluster of fields in offshore Malaysia with an export capacity of 750 MMCf/day, following Petronas’ transfer of operator right.

- Appalachia-focused US oil producer Diversified Energy (NYSE

Tuesday, January 28, 2025

The media frenzy of Donald Trump’s first week in office has not been reflected in oil price movement as ICE Brent continues to trade in a relatively thin bandwidth of $77-79 per barrel. However, risks are tilted to the downside with ballooning Dubai backwardation, continuously weak Chinese manufacturing numbers, and Trump’s messaging vis-à-vis OPEC. It would take a major disruption – such as a potential shutdown in Libya – to send Brent futures back above $80 per barrel.

Deportation Rows Adds to Trump Risk Premium. Donald Trump’s threats to slap a 25% tariff on Colombia’s imports to the United States have roiled commodity markets, with 41% of Colombian oil exports sold in the US, a move averted by Bogota’s agreeing to take in deported migrants.

Trump Halts All Environmental Litigation. US President Donald Trump has reportedly halted all pending environmental litigation and reassigned four Justice Department attorneys, despite not being political appointees, focused on the issue to the newly created Sanctuary City Working Group.

Protesters Seek to Block Libyan Exports Again. Oil loadings from two key Libyan ports, Es Sider and Ras Lanuf with a combined capacity of some 450,000 b/d, have been brought to a standstill after protesters blocked the sites, demanding that the state oil firm NOC relocate to the country’s east.

Chinese Teapots Halt Runs as Losses Deepen. As market premiums for Middle Eastern grades spiral out of control and import tariffs on fuel oil tripled, at least four Chinese teapot refiners with a combined capacity of 320,000 b/d have halted refinery operations in Shandong province this month.

Chevron Officially Starts Kazakhstan Megaproject. US oil major Chevron (NYSE:CVX) reached first oil from its $48 billion expansion project of the giant Tengiz field in Kazakhstan, hoping to reach peak output of 960,000 b/d by the end of Q2 2025, a 25% increase compared to previous output rates.

Europe Eases Sanctions on Syria. EU foreign ministers have agreed on a roadmap to ease sanctions on Syria following the fall of the Assad regime and the emergence of former al Qaeda commander Mohammad al-Julani as the country’s new leader, seeking to lift energy-related restrictions.

Bangladesh Banks On Louisiana LNG. Privately held LNG developer Argent LNG signed a non-binding agreement with the government of Bangladesh to supply 5 mtpa of liquefied gas from its planned 20 mtpa Port Fourchon facility, expected to start commercial operations in early 2030.

Sudan Civil War Puts an End to Refining. Government forces retook Sudan’s only refinery, the 100,000 b/d Khartoum plant, wresting control from Sudan’s rebel RSF militia that has kept it for two years, but this came at the cost of setting it ablaze with smoke plumes big enough to be captured by satellite imagery.

Miners Applaud Trump’s Policy. Global mining giant Rio Tinto (NYSE:RIO) said it is very optimistic about President Trump finally permitting the long-delayed Resolution copper project in Arizona, the US’ largest untapped deposit containing some 1.8 billion mt of copper, stalled for 12 years.

Fires Decimate Iraqi Oil Production. A fire that broke out over the weekend at Iraq’s largest oil field Rumaila has reduced production by 300,000 b/d and capped output rates could remain in place for several more days, reportedly after crude was reintroduced to a storage tank after maintenance.

Coffee Gets into Pricing Volatility Spiral. Coffee futures soared to an all-time high of $3.555 per pound after Donald Trump threatened to slap tariffs on Colombia, the world’s third-largest exporter of the commodity, adding a new layer of geopolitical risk premium to an already tight market.

BHP Gives Up on Anglo American Dream. According to the Financial Times, Melbourne-headquartered mining major BHP (NYSE:BHP) has given up on its goal to acquire rival miner Anglo American (LON:AAL), claiming the deal has become ‘too expensive’ after Anglo’s stock price rally.

US Power Prices Set to Rise This Year. The EIA expects higher wholesale electricity prices across the United States, with the notable exception of Texas and the Northwest, averaging $40 per MWh over the year, up 7% year-over-year, with California seeing the biggest increases.

| The Trump administration has directed agencies to suspend all federal grants and loans starting at close of business today. Why it matters: The new administration is showing signs — in its unilateral actions and legislative strategy — that it is more serious about fiscal austerity than the last time President Trump was in office.

|

jog on

duc