- Joined

- 24 July 2021

- Posts

- 123

- Reactions

- 350

Australians invest record amount in Wall Street as analysts warn 'at some stage the music will stop' - ABC News

https://www.abc.net.au/news/2025-01-07/australians-investing-wall-street-analysts-warning/104789944

www.afr.com

www.afr.com

Sounds like euphoria and irrational exhuberance just with US stocks.

https://www.abc.net.au/news/2025-01-07/australians-investing-wall-street-analysts-warning/104789944

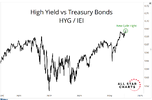

Super funds drain cash piles to go all-in on frothy markets

Australia’s multitrillion-dollar pension pool is the most bullish it’s been on stocks in over 10 years, leaving little room for error should markets go south.

Sounds like euphoria and irrational exhuberance just with US stocks.