- Joined

- 13 February 2006

- Posts

- 5,408

- Reactions

- 12,588

I fully follow the concept: Inflation ahead and USD maintained low (vs yuan,oil and gold)..no choice

But I have to sail my own boat: so AUD or NZD is what is critical in a selfish way.

The AUD or NZD have fallen vs the USD in the last years, should I expect this to continue: us being a us proxy .in worse..

Or should we expect a surge of the AUD as a gold/material proxy currency?

I think this is a question many are wondering about as the AUD USD rate is so critical to both assets values here and for many of the ASX 200 companies.

Sure, gold or silver could be a safe(r) play but manipulation is well known and there is only so much shiny bits you can own store

|

|

|

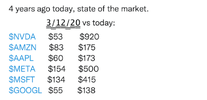

expect US health stocks to be 'jaw-boned ' lower during the US election cycle , in a desperate bid to catch votesView attachment 173152View attachment 173151View attachment 173150View attachment 173149View attachment 173148View attachment 173147View attachment 173146View attachment 173145View attachment 173144View attachment 173143View attachment 173142View attachment 173141

So interesting data on the last 3 Fed days. Once it was fade the initial move. Now it is go with the initial move.

As the RRP grind to zero, all eyes will be on Fed Reserves (bank reserves held at Fed) for issues. Previously QT 1 drained too fast. This time the Fed are slowing down. ISDA if it happens will be the way to prevent issues: ie. a licence to print money with no consequences for the banks, QE whatever and highly inflationary.

Sectors are getting over-extended. I'm starting to see some significant divergences in the sectors. For example Materials (XLB). I have been doing some selling (trimming) positions and taking profits. Of course, I could be too early, the momo is crazy to the upside atm.

jog on

duc

sub $40 for BHP would have tempted me last week , but no cigarLast week: go have a look at the on strength chart from last week.

View attachment 173228

For next week:

So I went bearish on health care. We'll see. It could be early.

View attachment 173227

View attachment 173229

Electricity is an issue: https://www.semafor.com/article/03/22/2024/electricity-bull-market

To me, this is one of the huge risk areas for BTC. You need the miners to complete transactions etc. You need Tether to trade this. You need someone willing to accept BTC, not everyone will. There are just too many moving parts and counter-parties.

BHP:

View attachment 173226

Not looking too clever atm. I saw @peter2 looking to buy.

jog on

duc

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.