- Joined

- 13 February 2006

- Posts

- 5,410

- Reactions

- 12,607

Full:https://www.wsj.com/finance/stocks/...a?st=BtHRk4&reflink=desktopwebshare_permalink

But never say never. The bulls have bought every dip and to date are laughing all the way to the bank.

Crypto:

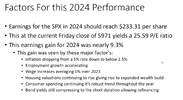

So if you have watched Mike Green's videos (posted above) you will understand the tremendous impact of the rise in passive.

With MSTR going into the QQQ's:

And Mr Saylor continuing his pursuit of the Holy Grail via btc + his copycats, you would expect btc to have a huge year next year. Price is set at the margin and with the dominant strategy of 'hodl' very few coins will be available to satisfy the MSTR monster. Price must skyrocket.

Increasingly as fewer and fewer players actually hold btc, its actual value will diminish, eventually by virtue of being held in such a concentrated manner, to zero.

This is the failure of an absolute finite supply. You actually need an ongoing supply of say 1% inflation of coins per year.

Of course, if the MSTR monster decides to sell: to whom will they sell?

Ultimately small 'hodl's' will need to sell out to lock in their profits. Trouble is their greed (to date) has been good. Eventually it will be bad. With visions of $1M, $10M, $100M a coin, when will that critical threshold be crossed?

The other issue is the correlation with QQQ

Now correlations are not written in stone, so they can evolve, change, etc.

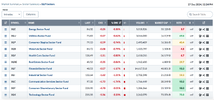

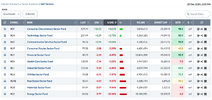

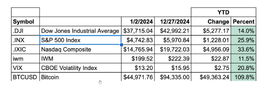

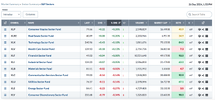

Pretty quiet day overall:

jog on

duc