- Joined

- 13 February 2006

- Posts

- 5,109

- Reactions

- 11,632

Jobs Report:

Rumors of a job market downturn were, it appears, greatly exaggerated.

Why it matters: A robust December employment report suggests the labor market is heating up — or at least not meaningfully cooling — as 2025 begins.

Catch up quick: The jobless rate fell, employers added to their payrolls, a larger share of the adult population was working, and wages rose at a healthy pace last month.

By the numbers: The U.S. economy added 256,000 jobs last month — the most since March 2024 and about 100,000 (!) more than economists had expected.

Oil News:

Oil prices have started the year rallying aggressively, with Brent breaking $80 per barrel for the first time since October 7 last year. The rally has been driven by the Biden Administration’s eleventh-hour sanctions on Russia, cold temperatures across the Atlantic Basin, widening backwardation in all crude futures, and continued concerns about inflation. For the first time in months, the oil market is feeling very bullish.

Yakuza Sells Nuclear Fuel to Iran. A top-tanking member of Japan’s Yakuza mafia pleaded guilty to trafficking uranium and plutonium from Myanmar to Iran after being arrested by an undercover DEA agent, just as recent reports indicate Tehran is now able to enrich uranium up to 60% purity.

China Loses Interest in Saudi Crude. Shortly after Saudi Aramco hiked formula prices for Asian term buyers by $0.50-0.60 per barrel for February, Chinese consumers have nominated 43.5 million barrels of Saudi barrels next month, down by 2.5 million barrels from the current month.

US Drillers Ignore Alaska Licensing Round. The US Interior Department received no bids in the latest government auction for drilling rights in Alaska’s Arctic National Wildlife Refuge, potentially hinting at the end of drilling there as all leases sold in the 2021 auction were eventually forfeited.

Iraq Crude Output Hampered by Power Outages. Disruptions in natural gas imports from Iran have led to power outages across Iraq that limited the latter’s oil production rates, with intermittent electricity supply lowering output at the supergiant Rumaila field that normally pumps some 1.2 million b/d.

Shandong Ports to Ban Sanctioned Tankers. The Shandong Port Group operating most of the ports that feed the province’s ‘teapot’ refiners announced it would ban all US-sanctioned tankers from calling into its terminals, despite accounting for 78% of all Iranian imports into China last year.

Norway Sold Record Levels of Gas in 2024. Norway’s Offshore Directorate reported that the country supplied record levels of natural gas last year, totaling 124 billion cubic meters compared to 116 bcm in 2023, whilst this year should see slightly lower production volumes at 120.4 bcm.

Chile Rejects Multi-Billion Iron Ore Project. Chilean officials have rejected a $3 billion mining and port project that was already approved back in 2021, but the Supreme Court annulled the decision two years later, saying incremental iron and copper mining would be overshadowed by environmental risks.

Venezuela Rekindles Fire Over Disputed Region. Tensions are running high across South America again after Venezuelan President Maduro is planning to elect a governor for the disputed oil-rich Essequibo province, historically part of Guyana but reclaimed by Caracas since ExxonMobil’s Guyanese discoveries.

Namibian Discoveries Might Not Be as Rosy. UK-based energy major Shell (LON:SHEL) has dampened expectations about Namibia’s oil bounty after writing off almost $400 million on wells drilled in its PEL-39 in the South African country, citing their sub-commercial nature due to a high gas-to-oil ratio.

Canada Threatens Orange Juice Tariffs on US. According to Canadian media, in case Donald Trump does impose a 25% tariff on goods imported from north of its border Canada could implement a retaliatory tariff on US orange juice, paper, steel products, glassware, and an array of plastic products.

Mega US Coal Merger Finally Approved. Shareholders of top US coal producers Consol Energy (NYSE:CEIX) and Arch Resources (NYSE:ARCH) voted to approve the companies’ plan to merge in a $5 billion deal, becoming Core Natural Resources and boosting 37 million st/year production capacity.

LA Fires Trigger Fuel Pipeline Closures. As deadly wildfires debilitate the Los Angeles area, US pipeline operator Kinder Morgan (NYSE:KMI) said it was forced to shut the 128,000 b/d CALNEV and 173,000 b/d SFPP West pipelines transporting oil products from LA refineries to San Diego and Phoenix.

Russian Refinery Offered to Kazakh Major. Kazakhstan’s state oil company KazMunayGas is bidding to purchase the 190,000 b/d capacity Burgas refinery in Bulgaria, the last downstream asset fully owned and operated by a Russian company in the European Union, sending a binding offer to Russia’s Lukoil.

Gold

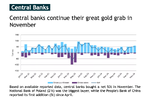

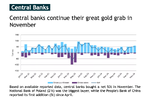

The gold price dip in November, following the US election, may have provided some central banks with added impetus to accumulate. At a country level, much of the buying was limited to those who have been active in recent months:

It was also announced in December that gold reserves at the Bank of Finland had been lowered by 10% to 44t – the sale most likely taking place during that month. The bank noted that: "Exchange rate risk is the most significant of the Bank of Finland’s financial asset risks. Increasing the size of its foreign exchange reserves elevates the Bank’s exchange rate risk considerably, and so the Bank is strengthening its foreign exchange rate provision by selling about 10% of its gold reserves".4This brings the bank’s gold reserves to their lowest level since December 1984.

Yields:

USD

Market:

China:

China’s post-pandemic malaise feels eerily similar to being trapped in a time loop. There is no forward motion. Barely four months ago, Beijing had investors believing it would do whatever it takes to revive its ailing economy. That led to an epic surge in share prices that has been abating for months as disappointment set in. Admittedly, a raft of policies was unleashed from the fiscal and monetary sides. Putting a floor under the real estate sector slump — at the heart of the economic troubles — was non-negotiable.

The humongous local government debts of over 60 trillion yuan ($8 trillion), according to International Monetary Fund estimates, continue to act like a lead weight. The excitement that the September pivot ushered in is effectively over, with little to show for officials’ resolve to get the economy back on track. Judging by the yields on Chinese bonds, investors are giving up on efforts to stop the world’s second-largest economy from sinking further. Yields on both two-year and 10-year bonds seem to be in a perpetual slide. Both have touched historic lows and continue to plummet — far from what should happen when a government has decided to go for broke with a big stimulus:

That plunge helps to explain the growing belief that an even more significant bailout from Beijing is coming. The leadership has no other choice. Investors’ impatience seems justified. The latest inflation print indicated that the economy is knee-deep in deflationary territory after consumer prices decelerated for the fourth straight month, while producer inflation is stuck in deflationary mode. Bloomberg Opinion colleague Mohamed El-Erian notes that this is all consistent with a deepening risk of “Japanification,” the prolonged period of stagnation that crippled Japan at the turn of the millennium. The longer this continues, El-Erian argues, the greater the risk of self-feeding vicious dynamics undermining growth, as well as household and corporate confidence.

Even with a further bailout firmly on the table, China’s 30-year yields have dropped below 2% and, amazingly, below equivalent Japanese bonds. Not long ago, this would have been inconceivable:

While the investor pessimism is concerning, the confidence sparked in Chinese equities by September’s pivot hasn’t been completely undone. Both mainland and offshore equity markets have held on to some of the gains. In the absence of the expected stimulus, and with US exceptionalism attracting ever more funds since the presidential election, it’s no surprise that Chinese stocks have fallen back. Given the economy’s importance, it’s also not surprising that this has driven a broader correction, with FTSE’s emerging markets index closing on Thursday 10% below its October peak, when the stimulus hype was greatest. That satisfies the most popular definition of a correction:

Still, this isn’t good enough. Beijing knows this. Stimulus to bolster consumer demand is a matter of when rather than if. Anatole Kaletsky of Gavekal Research notes that recent official announcements referencing phrases like “more pro-active fiscal policy” and “moderately loose monetary policy” suggest an imminent pivot. That should boost both consumption and investment and could also compensate for a loss of exports in the event of a full-scale trade war with the US:

jog on

duc

Rumors of a job market downturn were, it appears, greatly exaggerated.

Why it matters: A robust December employment report suggests the labor market is heating up — or at least not meaningfully cooling — as 2025 begins.

Catch up quick: The jobless rate fell, employers added to their payrolls, a larger share of the adult population was working, and wages rose at a healthy pace last month.

- That makes the outlook for further Fed interest rate cuts more remote. Another cut later this month now looks to be off the table, and market odds of a rate cut in March fell sharply this morning.

- With a solid labor market, officials can move more gingerly as price pressures look stickier.

By the numbers: The U.S. economy added 256,000 jobs last month — the most since March 2024 and about 100,000 (!) more than economists had expected.

- That partly reflects a bounce back from hurricane-induced payrolls weakness in the fall, but the strength is echoed in other data.

- The unemployment rate ticked down to 4.1% from 4.2%. (Remember the recession jitters that followed the jobless rate jump last summer? That looks increasingly more like a head fake.)

- The share of employed prime-age workers (those aged between 25 and 54) ticked up, rising 0.1% to 80.5% and recovering some of the losses since September.

- Average hourly earnings, a measure of wage growth, rose 0.3% in December and have increased by 3.9% over the previous 12 months.

- The economy added an average of 186,000 jobs per month last year, down from the 251,000 in 2023.

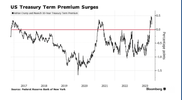

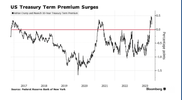

- The yield on the U.S. 10-year government bond rose to 4.78% this morning, the highest level since late 2023. That rate was 3.62% in mid-September when the Fed commenced its rate-cutting campaign.

- The Fed started its rate-cutting cycle with an eye on the labor market that, at the time, looked wobbly.

- Fears about the job market have since receded. Now there is a closer eye on inflation that has already ceased cooling, with risks that President-elect Trump's trade and immigration policies might reignite it.

- The Fed has cut rates by a full percentage point since September and Goolsbee says he still thinks "we have some to go."

Oil News:

Oil prices have started the year rallying aggressively, with Brent breaking $80 per barrel for the first time since October 7 last year. The rally has been driven by the Biden Administration’s eleventh-hour sanctions on Russia, cold temperatures across the Atlantic Basin, widening backwardation in all crude futures, and continued concerns about inflation. For the first time in months, the oil market is feeling very bullish.

Yakuza Sells Nuclear Fuel to Iran. A top-tanking member of Japan’s Yakuza mafia pleaded guilty to trafficking uranium and plutonium from Myanmar to Iran after being arrested by an undercover DEA agent, just as recent reports indicate Tehran is now able to enrich uranium up to 60% purity.

China Loses Interest in Saudi Crude. Shortly after Saudi Aramco hiked formula prices for Asian term buyers by $0.50-0.60 per barrel for February, Chinese consumers have nominated 43.5 million barrels of Saudi barrels next month, down by 2.5 million barrels from the current month.

US Drillers Ignore Alaska Licensing Round. The US Interior Department received no bids in the latest government auction for drilling rights in Alaska’s Arctic National Wildlife Refuge, potentially hinting at the end of drilling there as all leases sold in the 2021 auction were eventually forfeited.

Iraq Crude Output Hampered by Power Outages. Disruptions in natural gas imports from Iran have led to power outages across Iraq that limited the latter’s oil production rates, with intermittent electricity supply lowering output at the supergiant Rumaila field that normally pumps some 1.2 million b/d.

Shandong Ports to Ban Sanctioned Tankers. The Shandong Port Group operating most of the ports that feed the province’s ‘teapot’ refiners announced it would ban all US-sanctioned tankers from calling into its terminals, despite accounting for 78% of all Iranian imports into China last year.

Norway Sold Record Levels of Gas in 2024. Norway’s Offshore Directorate reported that the country supplied record levels of natural gas last year, totaling 124 billion cubic meters compared to 116 bcm in 2023, whilst this year should see slightly lower production volumes at 120.4 bcm.

Chile Rejects Multi-Billion Iron Ore Project. Chilean officials have rejected a $3 billion mining and port project that was already approved back in 2021, but the Supreme Court annulled the decision two years later, saying incremental iron and copper mining would be overshadowed by environmental risks.

Venezuela Rekindles Fire Over Disputed Region. Tensions are running high across South America again after Venezuelan President Maduro is planning to elect a governor for the disputed oil-rich Essequibo province, historically part of Guyana but reclaimed by Caracas since ExxonMobil’s Guyanese discoveries.

Namibian Discoveries Might Not Be as Rosy. UK-based energy major Shell (LON:SHEL) has dampened expectations about Namibia’s oil bounty after writing off almost $400 million on wells drilled in its PEL-39 in the South African country, citing their sub-commercial nature due to a high gas-to-oil ratio.

Canada Threatens Orange Juice Tariffs on US. According to Canadian media, in case Donald Trump does impose a 25% tariff on goods imported from north of its border Canada could implement a retaliatory tariff on US orange juice, paper, steel products, glassware, and an array of plastic products.

Mega US Coal Merger Finally Approved. Shareholders of top US coal producers Consol Energy (NYSE:CEIX) and Arch Resources (NYSE:ARCH) voted to approve the companies’ plan to merge in a $5 billion deal, becoming Core Natural Resources and boosting 37 million st/year production capacity.

LA Fires Trigger Fuel Pipeline Closures. As deadly wildfires debilitate the Los Angeles area, US pipeline operator Kinder Morgan (NYSE:KMI) said it was forced to shut the 128,000 b/d CALNEV and 173,000 b/d SFPP West pipelines transporting oil products from LA refineries to San Diego and Phoenix.

Russian Refinery Offered to Kazakh Major. Kazakhstan’s state oil company KazMunayGas is bidding to purchase the 190,000 b/d capacity Burgas refinery in Bulgaria, the last downstream asset fully owned and operated by a Russian company in the European Union, sending a binding offer to Russia’s Lukoil.

Gold

The gold price dip in November, following the US election, may have provided some central banks with added impetus to accumulate. At a country level, much of the buying was limited to those who have been active in recent months:

- The National Bank of Poland (NBP) was once again a major buyer. It increased its gold reserves by 21t in November, to 448t. Gold now accounts for almost 18% of its total reserves, just below the previously stated target of 20%.1 This purchase also cemented the NBP’s position as the leading gold buyer on a y-t-d basis (90t)

- Data published by the Central Bank of Uzbekistan shows its gold reserves rose by 9t during the month – the first monthly addition since July. As a result, the bank’s y-t-d net purchases now total 11t and total gold holdings amount to 382t

- The Reserve Bank of India continued its 2024 buying streak, adding a further 8t to its gold reserves in November. This lifts y-t-d buying to 73t and total gold holdings to 876t, maintaining its position as the second largest buyer in 2024 after Poland2

- The National Bank of Kazakhstan increased its gold reserves by 5t, the second successive month of buying. As a result, the bank has flipped to being a net purchaser (1t) y-t-d, with total gold holdings now standing at 295t

- One of the most notable developments during the month was the announcement that the People's Bank of China (PBoC) had resumed gold purchases. After a six-month hiatus, the PBoC added 5t of gold to its reserves, increasing its y-t-d net purchases to 34t and its total reported gold holdings to 2,264t (5% of total reserves)

- Data published by the Central Bank of Jordan shows its gold reserves rose by over 4t in November - the first monthly increase since July. Y-t-d net purchases now total nearly 2t, lifting gold holdings to 73t

- The Central Bank of Turkey increased its gold reserves by 3t during the month. The central bank also entered into reverse swap agreements (gold for lira) with domestic commercial banks to manage liquidity

- Gold reserves held by the Czech National Bank rose by almost 2t in November – the 21st consecutive month of buying. Y-t-d net purchases now total almost 20t, lifting gold holdings to just above 50t

- The Bank of Ghana continued its gold accumulation as part of its domestic gold purchase programme, adding a further 1t in November. Y-t-d net purchases now total almost 10t, lifting total gold holdings to 29t. The bank also launched a Ghana Gold Coin to the public during the month as part of its “efforts to stabilise the economy and promote investment in Ghana’s gold reserves”3

- The Monetary Authority of Singapore was the month’s largest seller, reducing its gold reserves by 5t, bringing y-t-d net sales to 7t and overall gold holdings to 223t.

It was also announced in December that gold reserves at the Bank of Finland had been lowered by 10% to 44t – the sale most likely taking place during that month. The bank noted that: "Exchange rate risk is the most significant of the Bank of Finland’s financial asset risks. Increasing the size of its foreign exchange reserves elevates the Bank’s exchange rate risk considerably, and so the Bank is strengthening its foreign exchange rate provision by selling about 10% of its gold reserves".4This brings the bank’s gold reserves to their lowest level since December 1984.

Yields:

USD

Market:

China:

China’s post-pandemic malaise feels eerily similar to being trapped in a time loop. There is no forward motion. Barely four months ago, Beijing had investors believing it would do whatever it takes to revive its ailing economy. That led to an epic surge in share prices that has been abating for months as disappointment set in. Admittedly, a raft of policies was unleashed from the fiscal and monetary sides. Putting a floor under the real estate sector slump — at the heart of the economic troubles — was non-negotiable.

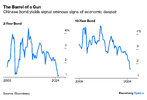

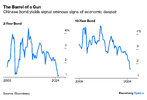

The humongous local government debts of over 60 trillion yuan ($8 trillion), according to International Monetary Fund estimates, continue to act like a lead weight. The excitement that the September pivot ushered in is effectively over, with little to show for officials’ resolve to get the economy back on track. Judging by the yields on Chinese bonds, investors are giving up on efforts to stop the world’s second-largest economy from sinking further. Yields on both two-year and 10-year bonds seem to be in a perpetual slide. Both have touched historic lows and continue to plummet — far from what should happen when a government has decided to go for broke with a big stimulus:

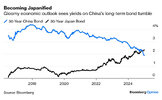

That plunge helps to explain the growing belief that an even more significant bailout from Beijing is coming. The leadership has no other choice. Investors’ impatience seems justified. The latest inflation print indicated that the economy is knee-deep in deflationary territory after consumer prices decelerated for the fourth straight month, while producer inflation is stuck in deflationary mode. Bloomberg Opinion colleague Mohamed El-Erian notes that this is all consistent with a deepening risk of “Japanification,” the prolonged period of stagnation that crippled Japan at the turn of the millennium. The longer this continues, El-Erian argues, the greater the risk of self-feeding vicious dynamics undermining growth, as well as household and corporate confidence.

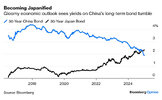

Even with a further bailout firmly on the table, China’s 30-year yields have dropped below 2% and, amazingly, below equivalent Japanese bonds. Not long ago, this would have been inconceivable:

While the investor pessimism is concerning, the confidence sparked in Chinese equities by September’s pivot hasn’t been completely undone. Both mainland and offshore equity markets have held on to some of the gains. In the absence of the expected stimulus, and with US exceptionalism attracting ever more funds since the presidential election, it’s no surprise that Chinese stocks have fallen back. Given the economy’s importance, it’s also not surprising that this has driven a broader correction, with FTSE’s emerging markets index closing on Thursday 10% below its October peak, when the stimulus hype was greatest. That satisfies the most popular definition of a correction:

Still, this isn’t good enough. Beijing knows this. Stimulus to bolster consumer demand is a matter of when rather than if. Anatole Kaletsky of Gavekal Research notes that recent official announcements referencing phrases like “more pro-active fiscal policy” and “moderately loose monetary policy” suggest an imminent pivot. That should boost both consumption and investment and could also compensate for a loss of exports in the event of a full-scale trade war with the US:

Kaletsky points out that if this acceleration becomes apparent, Chinese stocks will look undervalued, and commodity prices will gain support. That helps to explain why investors in Chinese equities aren’t fully abandoning their positions. Freya Beamish of TS Lombard points out that Beijing’s knack for due process could be delaying the stimulus, as it prefers to bring all parties to the table before making a move:On top of the newfound policy commitment to demand expansion, the economy will also benefit from structurally accelerating trade growth among emerging markets. And perhaps most importantly, China is achieving dominance in many of the fastest-growing global industries, including electric vehicles, solar, wind and nuclear energy, batteries, generic pharmaceuticals, and mass-market semiconductors — such dominance should be reinforced by the Trump administration’s antagonism to several of these sectors.

Ahead of China’s Lunar New Year, the Year of the Wood Snake, which falls on Jan. 29, officials hope to invoke animal spirits. Snakes symbolize wisdom and agility in Chinese culture, while wood stands for growth, flexibility and tolerance. With Donald Trump taking office the week before, the wood snake couldn’t have chosen a better time to make an appearance.The worry is that the Chinese Community Party’s idea of re-orienting towards domestic demand is simply to hand out vouchers for goods, the vast majority of which would simply be Chinese. But the rumour mill also includes more lasting elements such as child benefits expansion. At the same time, some greater efforts at domestically oriented investment seem likely to be part of the mix. While this won’t help China — where overinvestment has been rife for the last two decades — it would help to soak up a little more of the excess savings domestically.

jog on

duc