- Joined

- 13 February 2006

- Posts

- 5,393

- Reactions

- 12,547

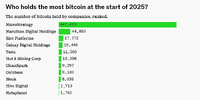

Good for my btc portfolio

Clearly yes it will.

To a point.

Currently (absent any issues with Tether etc) the correct strategy has been to buy and hold. That will continue to be the correct strategy until the correct strategy is to be the first to sell.

Then it returns to zero as it will all be owned by a very small group or even a single person.

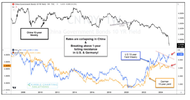

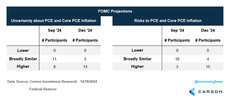

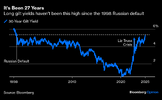

Credit spreads are insanely tight. As such, the risk is incredibly high.

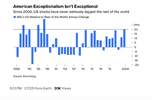

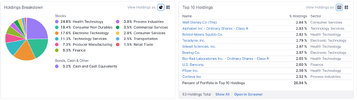

Pretty high multipliers being accorded to earnings. Again, risk increases.

jog on

duc