CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

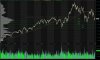

I always hate to be too bullish or bearish, it tends to cloud your judgement for too long and as an intraday outright trader, i need to be able to flip...well right now, holy crap i'm bearish and i just can't shake it

and i just can't shake it Every equity index chart i open has lower extensions ending 7-10% lower from current closes....

Every equity index chart i open has lower extensions ending 7-10% lower from current closes....