CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Well the Santa Claus rally might not happen, most markets are definetly posturing bearishly more than bullishly.

Where is Sinner with his indicators?

I'd say we're looking at a gap down in Europe today unless the Asian markets make up ground lost on the back of the news

The other news thats affecting the Yen is

So its caught a bid this morning too....

So might be the time for some longs to liquidate! Sorry Santa :ak47: :xmaswave:, you're not welcome here this year, especially in the classroom!

Where is Sinner with his indicators?

I'd say we're looking at a gap down in Europe today unless the Asian markets make up ground lost on the back of the news

09:56*(CN) CHINA NOV TRADE BALANCE: CNY343.1B v CNY407.5Be- Exports Y/Y: % v -5.0%e- Imports Y/Y: % v -11.9%e - Source TradeTheNews.com

The other news thats affecting the Yen is

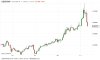

07:50*(JP) JAPAN Q3 FINAL GDP Q/Q: 0.3% V 0.0%E; ANNUALIZED GDP: 1.0% V 0.2%E; Japan AVOIDS technical recession- Nominal GDP: 0.4% v 0.2%e- GDP Deflator: 1.8% v 2.0%e - Source TradeTheNews.com

So its caught a bid this morning too....

So might be the time for some longs to liquidate! Sorry Santa :ak47: :xmaswave:, you're not welcome here this year, especially in the classroom!

:bad:

:bad:

.

.