Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,468

- Reactions

- 11,908

USD Au Bouncing off 1750 and through 1775 overnight looks positive, so far. AUD seems to be going up too though...

Cu up nearly 4%

Cu up nearly 4%

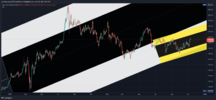

I usually only look at gold on a quarterly basis but today I can see more in the long term weekly chart. It may be about to break out on the upside of a normally bearish descending triangle. The price has mostly been riding high in the triangle until now where it appears to be taking a bounce upward off the straight base of the triangle.

That's the handle on a 10 year cup, Ann. Target around $2600 ish.

And that comet will take the form of the likes of JP Morgan and the other big banks piling on the shorts in the paper trade on the CME,USD POG now at 1832, above the Jul and Sep highs of 1829 and 1826 resistance points. The downward diagonal line is about the same point, so if there's a break through it beats a couple of key resistance levels. It's not an algo chart so might be off a few notches. I've read on Kitko, chartists calling 1835 the key resistance level.

It's been a solid run since the Sep 29 low of 1725 with a couple of bouncy bouncies*, so expect another breather shortly. Perhaps it will be at this diagonal resistance level, but making a higher high is now the first step on the way back to 1900, then 2070, and then the 2600 ish giant C&H target.

Having said the above, I'll hedge my bets with the fact there's a huge comet heading towards Earth.

And that comet will take the form of the likes of JP Morgan and the other big banks piling on the shorts in the paper trade on the CME,

History has a habit of repeating.

Mick

Highest close since July was $1832, so Kitco's resistance at $1835 is just rounding, not that a few dollars will make much difference.USD POG now at 1832, above the Jul and Sep highs of 1829 and 1826 resistance points. The downward diagonal line is about the same point, so if there's a break through it beats a couple of key resistance levels. It's not an algo chart so might be off a few notches. I've read on Kitko, chartists calling 1835 the key resistance level.

Highest close since July was $1832, so Kitco's resistance at $1835 is just rounding, not that a few dollars will make much difference.

I have tracked TSI on 4 hourly charts to get an idea of how much more upside is possible, and where we are today is similar to where we stood in May. That continued to over $1900 in June, so maybe we get a repeat before a major retracement.

We have been forecasting that gold would challenge and breach $1837 by the end of 2021. We have also been forecasting that gold would challenge $1900 per ounce in gold by end of the first quarter of 2022. Although when I first put forth our short-term and longer-term forecast it seemed as though those numbers were out of reach. Considering that gold today has risen for the fourth consecutive day and as of 5:55 PM EST is fixed at $1833.80, a net gain of $5.80 and traded to a high today of $1834.80, the forecast seems more realistic than 2 months ago.

Below are medium term (2 year) and short term (5 month) trend envelopes:

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.