- Joined

- 25 July 2021

- Posts

- 877

- Reactions

- 2,215

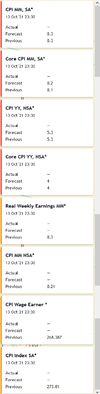

At this point I'm still not convinced that Gold will go straight up from here, I'm looking to see if more general sideways movement or a final leg down may come into play. I've just received another Gann video that talks about two paths forward from here, see below;

CLICK TO WATCH

CLICK TO WATCH