Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,459

- Reactions

- 11,895

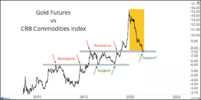

A clear break though is probably what was desired, but not expected. I thought more consolidation would have been healthier. But, perhaps there had been enough bouncy bouncy* sideways for a significant break to occur at some stage. Also perhaps once a break was happening technical traders jumped in to drive it. The levels we've been discussing have been circulating around the place. Been watching this closely since the 29 Sep low with high expectations so this is quite satisfying. Next stop is the June high at $1907.

Gold price has room to run to $1900

*TM @finicky

Gold price has room to run to $1900

(Kitco News) - The gold market is seeing new bullish momentum after U.S. inflation data rose to its highest level in more than three decades, and some analysts are looking for a move back to $1,900 an ounce in the near term.

According to some analysts, gold is catching a new bid as inflation pressures ramp up, raising concerns that the Federal Reserve will be behind the inflation curve.

"Inflation is here and it's only going to get worse," said Bob Haberkorn, senior commodities broker with RJO Futures. "There is a major concern that the Federal Reserve is limited to what it can do to stop inflation from rising. There is a real fear among investors that the Fed will lose control."

The latest inflation data pointed to broad-based increases in consumer goods. Food was up 5.3% from a year ago – the biggest increase since January 2009. Gasoline prices surged 6.1%, marking the biggest gain since March.

The rise in inflation comes as U.S. consumers start their holiday shopping and prepare for Thanksgiving.

Helping to support gold's breakout through critical resistance at $1,835 has been a drop in real interest rates. Following the latest Consumer Price Index data, real yields on 10-year notes dropped to a record low of -1.235%.

Along with the drop in real yields the break-even rate, the difference between nominal 10-year bond yields and Treasury Inflation-Protected Securities rose to 2.64%. Analysts note this indicates that bond markets are pricing in even more inflation risk.

While off their highs, gold prices last traded at $1,858 an ounce, up 1.5% on the day. The precious metal is currently trading at a five-month high.

Haberkorn added that he expects that this is just the start of gold's move higher. He said that his next target for gold is between $1,900 and $1,920.

*TM @finicky