You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

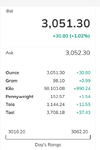

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,934

- Reactions

- 10,919

From another thread.

www.aussiestockforums.com

www.aussiestockforums.com

One wonders what effect the US Treasury purchase of BTC with gold reserves will have on the price of gold.

gg

Trump Era 2025-2029 : Stock and Economic Comment

Markets are getting nervous. This is your single biggest indicator of general market sentiment and as you can see it's shot up by miles since mid feb. HY = High Yield IG = Investment Grade (risky but high return vs AAA rated but low return. Rates are plotted on the left and right axes...

www.aussiestockforums.com

www.aussiestockforums.com

One wonders what effect the US Treasury purchase of BTC with gold reserves will have on the price of gold.

gg

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,934

- Reactions

- 10,919

how long is a piece of string bloke

just beautiful ...

Kind regards

rcw1

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,539

- Reactions

- 12,028

I think the average of the last 2 big gold bull markets was 8 x from the breakout. Not sure if the conditions are exactly the same.

- Joined

- 8 March 2007

- Posts

- 3,012

- Reactions

- 4,188

Have you taken into Consideration the Fact that the Earth is ROUND!

ie: NOT FLAT!

In a Round Earth World Ships and Everything look a lot smaller as they go further into the Horizon

As an old Architectural Student we called this PERSPECTIVE and

BTW I won the Australia wide Competition to Design and Build the 1970 Expo in OSAKA Japan in 1968/69

The rest is a long story

Back to "Perspective"

I have found that Long Term Calculations/ Prophesies are Best Studied in LOGARITHMIC SCALE!

FWIW: " The Friend is Your Friend Until She Is NOT"

ie: NOT FLAT!

In a Round Earth World Ships and Everything look a lot smaller as they go further into the Horizon

As an old Architectural Student we called this PERSPECTIVE and

BTW I won the Australia wide Competition to Design and Build the 1970 Expo in OSAKA Japan in 1968/69

The rest is a long story

Back to "Perspective"

I have found that Long Term Calculations/ Prophesies are Best Studied in LOGARITHMIC SCALE!

FWIW: " The Friend is Your Friend Until She Is NOT"

That's why the myth about Christopher Columbus' crew trying to mutiny as the ship got closer to falling off the edge of the earth is pure bulldust , Captain . Never happened !In a Round Earth World Ships and Everything look a lot smaller as they go further into the Horizon

Back on topic. I'll be hanging on to my Globalx gold etf and perth mint until they have made 100 % before I'll even think about bailing out . Not long to wait , I'm thinking now .

Similar threads

- Replies

- 4

- Views

- 957

- Replies

- 171

- Views

- 11K

- Replies

- 9

- Views

- 2K