- Joined

- 25 July 2021

- Posts

- 881

- Reactions

- 2,226

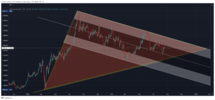

Yes I agree that the very long term future looks very good for Gold. Your EW analysis, wave three is the big one, also we see a cup and handle pattern on your ten year chart, very bullish, and the market is trying to get on the track of the Gann 90 year cycle, also very long term bullish. The fundamentals are good for Gold & Silver when the economy gets moving and all the new tech is being built for EV and automation. Keeping all these in mind, I like monitor and keep reassessing what is happening.In all from the 6mo. chart and beyond the 6mo.chart, gold is in an EW pattern Wave 2, with the sub-pattern about to complete it's 1-2-3.

Now it looks to me as if a Wave 3 is about to develop, i.e. a re-rating of gold to bullish.

I hope this is not breaking any rules. This is a Gann look at Gold, I hope the link works.

CLICK TO WATCH

BULLISH HAMMER IN GOLD POINTING TO NEW ALL-TIME HIGHS BEFORE YEAR END.

well that is depressing

i was hoping to calmly and opportunistically add more gold stocks in the coming year

DYOR

This is a follow up video from the last one which looks at Gold through a Gann lens;I hope this is not breaking any rules. This is a Gann look at Gold, I hope the link works.

CLICK TO WATCH

We could have a higher low forming here and for me, that would make a good entry point. Depends on what it does tonight.perhaps some investors/traders have missed ithe run up

The price of gold has poked through the $2500 handle.

This is thanks to falls in the AUD in most recent days, so perhaps some investors/traders have missed ithe run up due to only looking at the USD/Gold price.

At these prices, one might expect some improvement in the ASX goldies, but they are still languishing somewhat.

If these prices hold, or even better , keep going up, it will likely transform into improved prices for gold stocks.

Mick

I have a couple of charts that do indicate more down for Gold. The first chart below shows the 50 day MA and the 200 day MA are both down and price is still below them both.My thinking is that breakout to the upside is 2 to 4 weeks away.

But any further sharp declines can push this into end of year.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.