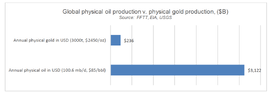

Just in case you are not aware that gold is good... Wrap ya mellon round this little beauty !!!quGood afternoon

Gold continues to impress, improving on the threshold of value overall and bouncing into zones that will be become second nature before too long.

No sell by rcw1. Yellow (physical) is gold

Go Queensland women in SoO 1 tonight. The place is abounded in maroon... XXXX on the menu.

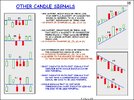

View attachment 176966