You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,377

- Reactions

- 11,742

The good the bad and the ugly

PoG down US $47.80

Good nite Irene

Kind regards

Rcw1

About time we had a decent correction and consolidation on gold and silver. Decent support on the charts is still way south.

- Joined

- 12 January 2008

- Posts

- 7,365

- Reactions

- 18,408

Yep, the market needed a pause. IMO if the price respects 2200 (1/2 way between 2000 - 2400), then I'd consider that bullish. Would not like to see price fall back to 2000.

Edit: If 2300 provides support that's very bullish and we're looking at 3000 next.

Unfortunately the gold producers will fall, even though the the average POG is rising swiftly. Unhedged miners should be making hay selling into current spot prices and many should report increases in revenue when they next report.

Edit: If 2300 provides support that's very bullish and we're looking at 3000 next.

Unfortunately the gold producers will fall, even though the the average POG is rising swiftly. Unhedged miners should be making hay selling into current spot prices and many should report increases in revenue when they next report.

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

The Gold Sector Is Due for a Shake Out

By Jeff Clark, editor, Market Minute

Suddenly, everyone wants to buy gold stocks. That means, the sector is due for a short-term shake out.

Let me explain…

Gold stocks have been on fire lately. The Gold Bugs Index (HUI) was trading at 200 at the end of February. It closed Friday above 262. That’s a 31% gain in just seven weeks.

And, as is often the case, price action has a way of changing investor sentiment.

Nobody wanted anything to do with the gold sector in late February. I know this because when we published a bullish essay on gold stocks on March 1, we got lots of feedback from readers threatening to cancel their free subscriptions.

Now, most of the feedback we get about gold and gold stocks is from readers wanting to know if they should chase the prices higher.

The short answer is “No.” For the long answer, take a look at this chart of the Gold Bugs Index…

The first thing to notice about this chart is how the recent rally is quite similar to the action during the same time last year. Indeed, March and April tend to be seasonally bullish for gold stocks.

But, that seasonal strength ends in May. The gold sector tends to decline through the summer and into the fall.

Notice also that all of the momentum indicators at the bottom of the chart have started to decline from overbought conditions. This too is similar to what happened about this time last year – just before HUI lost about 30% of its value.

Of course, that doesn’t mean we’ll see the same sort of decline this year as well. Even after the recent rally, gold stocks are still about as fundamentally cheap as they have ever been. And, the reasons for owning gold as an inflation hedge and as a store of value are as strong as ever.

So, I still like the idea of owning gold stocks for the intermediate- and longer-term timeframes. I expect the sector will be even higher by the end of the year.

For the short-term, though, I’m skeptical. Investor sentiment towards gold stocks has gone from bearish to bullish too fast. This is happening just as we are entering a seasonally weak period for the sector.

Rather than chasing prices higher, traders will probably do better by being patient and waiting for the gold sector to work off its current overbought conditions. Chances are, we’ll get a better opportunity to buy the gold stocks a few months from now.

Best regards and good trading,

Jeff Clark

By Jeff Clark, editor, Market Minute

Suddenly, everyone wants to buy gold stocks. That means, the sector is due for a short-term shake out.

Let me explain…

Gold stocks have been on fire lately. The Gold Bugs Index (HUI) was trading at 200 at the end of February. It closed Friday above 262. That’s a 31% gain in just seven weeks.

And, as is often the case, price action has a way of changing investor sentiment.

Nobody wanted anything to do with the gold sector in late February. I know this because when we published a bullish essay on gold stocks on March 1, we got lots of feedback from readers threatening to cancel their free subscriptions.

Now, most of the feedback we get about gold and gold stocks is from readers wanting to know if they should chase the prices higher.

The short answer is “No.” For the long answer, take a look at this chart of the Gold Bugs Index…

The first thing to notice about this chart is how the recent rally is quite similar to the action during the same time last year. Indeed, March and April tend to be seasonally bullish for gold stocks.

But, that seasonal strength ends in May. The gold sector tends to decline through the summer and into the fall.

Notice also that all of the momentum indicators at the bottom of the chart have started to decline from overbought conditions. This too is similar to what happened about this time last year – just before HUI lost about 30% of its value.

Of course, that doesn’t mean we’ll see the same sort of decline this year as well. Even after the recent rally, gold stocks are still about as fundamentally cheap as they have ever been. And, the reasons for owning gold as an inflation hedge and as a store of value are as strong as ever.

So, I still like the idea of owning gold stocks for the intermediate- and longer-term timeframes. I expect the sector will be even higher by the end of the year.

For the short-term, though, I’m skeptical. Investor sentiment towards gold stocks has gone from bearish to bullish too fast. This is happening just as we are entering a seasonally weak period for the sector.

Rather than chasing prices higher, traders will probably do better by being patient and waiting for the gold sector to work off its current overbought conditions. Chances are, we’ll get a better opportunity to buy the gold stocks a few months from now.

Best regards and good trading,

Jeff Clark

- Joined

- 13 February 2006

- Posts

- 5,264

- Reactions

- 12,116

So a couple of macro articles that really underline why gold is moving higher and will continue to move secularly higher, albeit with volatility.

Full article: https://www.bloomberg.com/opinion/a...s-is-bad-news-for-trump-and-gop-isolationists

Second: https://www.macrovoices.com/podcast...ndustry-in-not-prepared-for-secular-inflation

Now this is from 2018.

His views today: https://research.gavekal.com/content/webinar-forward-to-the-1970s-investing-for-an-inflationary-age/

We are in Cold War II. The only problem is that the US is the former Soviet Empire and China is the US as it was.

Reagan as you will remember, bankrupted the Soviets. Which is exactly what the Chinese are doing as we speak, to the US.

Currencies not backed by gold will simply cease to exist (hold any purchasing power) through relentless inflation. The only way to protect your personal wealth is via physical gold. I have recently gone with the BTC argument, but I wouldn't actually hold any myself. If you believe the hype, go with it. The lesson however I think will be: you buy what the winners buy/hold, ie. China and gold.

jog on

duc

Full article: https://www.bloomberg.com/opinion/a...s-is-bad-news-for-trump-and-gop-isolationists

Second: https://www.macrovoices.com/podcast...ndustry-in-not-prepared-for-secular-inflation

Now this is from 2018.

His views today: https://research.gavekal.com/content/webinar-forward-to-the-1970s-investing-for-an-inflationary-age/

We are in Cold War II. The only problem is that the US is the former Soviet Empire and China is the US as it was.

Reagan as you will remember, bankrupted the Soviets. Which is exactly what the Chinese are doing as we speak, to the US.

Currencies not backed by gold will simply cease to exist (hold any purchasing power) through relentless inflation. The only way to protect your personal wealth is via physical gold. I have recently gone with the BTC argument, but I wouldn't actually hold any myself. If you believe the hype, go with it. The lesson however I think will be: you buy what the winners buy/hold, ie. China and gold.

jog on

duc

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

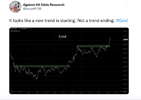

GLD is sitting at an important price support level at the moment, it's the 150% level of the range from the Mar22 high down to the Nov22 low and the 200% level of the range from the Feb23 low up to the May 23 high. If the market falls below this price level then it's the start of a more substantial pullback but if this price level holds then the 236 area could be the price level at which a substantial pullback will start.

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,773

- Reactions

- 10,531

We have had quite a nice move in Gold this year and now the patient waiting time is here. Who knows where it will go? There is sufficient existential bastardry between the Israeli and Arab cousins to suggest that geopolitical events will continue to affect the price over the next five years. I see no reason why this will not lead to a 50%-100% rise in the price from here.

The China and BRICS attempts to devolve from the $USD as the currency of commerce to a new gold standard has been discussed, and this I believe will form a base at above $USD2000 going forward.

On technical grounds, over the last 5 years, Gold appears to be set in a Wave 3 EW with some more to go perhaps or even some further retracement to $2050 before the next leg up. It would be better for Gold investors though if some consolidation occurred at $USD2500 before the next leg reveals itself.

Bitcoin should not be a problem. Despite opinion to the contrary I see no reason why it should not get smashed as the economy in the USA continues to improve and further muppetry of the Bankman-Fried flavour evolve in the "currency" of global chicanery.

All in all I feel very comfortable going in to next week and may even add some bar on any weakness.

gg

The China and BRICS attempts to devolve from the $USD as the currency of commerce to a new gold standard has been discussed, and this I believe will form a base at above $USD2000 going forward.

On technical grounds, over the last 5 years, Gold appears to be set in a Wave 3 EW with some more to go perhaps or even some further retracement to $2050 before the next leg up. It would be better for Gold investors though if some consolidation occurred at $USD2500 before the next leg reveals itself.

Bitcoin should not be a problem. Despite opinion to the contrary I see no reason why it should not get smashed as the economy in the USA continues to improve and further muppetry of the Bankman-Fried flavour evolve in the "currency" of global chicanery.

All in all I feel very comfortable going in to next week and may even add some bar on any weakness.

gg

Good eveningWe have had quite a nice move in Gold this year and now the patient waiting time is here. Who knows where it will go? There is sufficient existential bastardry between the Israeli and Arab cousins to suggest that geopolitical events will continue to affect the price over the next five years. I see no reason why this will not lead to a 50%-100% rise in the price from here.

The China and BRICS attempts to devolve from the $USD as the currency of commerce to a new gold standard has been discussed, and this I believe will form a base at above $USD2000 going forward.

...

China and Taiwan relationship is one hell of a 'flash point'. There are some that believe China's infatuation with gold is a sign of readiness for aggression.

Have a very nice week.

Kind regards

rcw1

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

- Joined

- 13 February 2006

- Posts

- 5,264

- Reactions

- 12,116

In the West:

The 'shortages' are real. While going out to buy 20 or 30 ounces is not an issue currently, the continued demand from the East for tonnes of physical is starting to break the system and soon enough, trying to buy ANY physical will be suspended or unavailable.

A rising gold price is one of the few signals that cannot be fudged away by the authorities in charge of your fiat.

jog on

duc

The 'shortages' are real. While going out to buy 20 or 30 ounces is not an issue currently, the continued demand from the East for tonnes of physical is starting to break the system and soon enough, trying to buy ANY physical will be suspended or unavailable.

A rising gold price is one of the few signals that cannot be fudged away by the authorities in charge of your fiat.

jog on

duc

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,773

- Reactions

- 10,531

Further to @ducati916 post above on Gold scarcity, I did a search this afternoon on X-Twitter for #Gold. A few posts caught my eye.

Some quite nice Fibonacci levels, targets gained and retracements for the tea leaf reading cousins on ASF.

On with the dance.

gg

- Poland CB is buying Gold, large quantities in the first quarter. Poland is a front line defender in any possible European war against the East.

- Retail Gold Buying in China has gone through the roof.

Some quite nice Fibonacci levels, targets gained and retracements for the tea leaf reading cousins on ASF.

On with the dance.

gg

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,377

- Reactions

- 11,742

- Joined

- 12 January 2008

- Posts

- 7,365

- Reactions

- 18,408

"Beware the anticipated third wave" - Anon trader

- Joined

- 13 February 2006

- Posts

- 5,264

- Reactions

- 12,116

Gold:

Moving from West to East. This trend is not new.

Not only the big flows in tonnes to the Central Banks, but the little chaps.

Full: https://www.cips.com.cn/en/participants/participants_announcement/61182/index.html

Way behind the times and reality.

China, Russia way ahead of the curve strategically.

Gold is/will become the reserve asset replacing UST.

jog on

duc

Moving from West to East. This trend is not new.

Not only the big flows in tonnes to the Central Banks, but the little chaps.

Full: https://www.cips.com.cn/en/participants/participants_announcement/61182/index.html

Way behind the times and reality.

China, Russia way ahead of the curve strategically.

Gold is/will become the reserve asset replacing UST.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,264

- Reactions

- 12,116

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,494

- Reactions

- 4,598

Lots of data underlining a major bull run underway:

View attachment 176556View attachment 176555View attachment 176554View attachment 176553View attachment 176552View attachment 176551View attachment 176550View attachment 176549

China seem to be canny buyers of gold. An excellent leading indicator.

View attachment 176557

CNY is not going to devalue. USD will devalue.

View attachment 176566

View attachment 176567

jog on

duc

The bull has definitely taken control of the precious metals market. Last night's silver price action was the most bullish in recent memory. The buying was relentless and the pullbacks were brief and shallow. Gold looks like it went similarly. Both gold and silver finished the trading day at or near their daily highs.

I expect that both gold and silver will take another crack at April's highs during May (or perhaps June). US$2,400 is the challenge for gold and US$30 is the challenge for silver.

What is particularly interesting is that the second quarter of the year is usually the worst for precious metals, so the strength of this bull run is even more surprising given that you would expect historical seasonality this quarter to be a headwind.

Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,547

- Reactions

- 22,561

I thought Scots were meant to be canny , and the Chinese inscrutable.China seem to be canny buyers of gold.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,377

- Reactions

- 11,742

Similar threads

- Replies

- 1

- Views

- 527

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K