- Joined

- 13 February 2006

- Posts

- 5,379

- Reactions

- 12,481

View attachment 180074

Thanks @DaveTrade

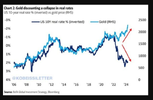

I just thought I'd put up a chart going back to the laate 1970's when I first started accumulating Gold. At that stage I paid $600 when the $AUD had parity with the $USD, and just hid it as it did not move significantly (and fell ). To put it in context I went with a mate to view a terraced house he eventually bought in Surry Hills for $32,000. My mate, if he had held on to it would have done much better than I, income and capital value wise.

So you are correct. Gold may fall as it did in Oct 2011 from $1900 to $1100. My guess is that we are in a Dec 06 situation where gold ran up to $1900 from $600 over 5 years. Not spectacular I agree. I guess it depends where you enter and if you are a short term trader or a long term holder and how you value Gold as a holding in your portfolio.

It is always good to have consolidation.

mmmmm. @DaveTrade . I'm not long relatively left in this world. You got me thinking. LOL.

gg

Mr GG

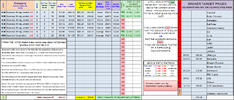

Your gold holding is not an investment play as say stocks.

It is the the cash component of your overall portfolio. So if you held say 20% as cash, you would hold 15% as gold and 5% as cash to pay the bills etc.

Some in property, your home for example.

Some in stocks.

Some in a trading account for speculation

You only move to bonds etc if the real return is positive after inflation. Since inflation is actually around 15%, that won't be anytime soon.

You get the idea.

jog on

duc