- Joined

- 8 March 2007

- Posts

- 2,811

- Reactions

- 3,859

So quiet I can hear a pin drop.

Go Figure?Seems to me that everyone has fallen out of love with their Pet Rocks

Love is so fickle!

Last edited:

So quiet I can hear a pin drop.

Go Figure?Seems to me that everyone has fallen out of love with their Pet Rocks

Did you ever know me to Set Sail in the Face of a Storm on a Friday ?A tricky situation with our dollar and rising yields. It's trading at 6 month low or more....what do you say? Stay out or ?

You gonna have a day off tomorrow? It's a public holiday in Vic, Captain.

On a very short term market structure basis, I feel that 2912-2925 is critical support, inability to hold that zone in context of the medium term pattern of the last 6 months, is negative.

View attachment 161045

blugh.

https://gold-forum.kitco.com/newreply.php?do=newreply&p=2796826Over the many years I have been investing in gold and silver, I have come to the realization that anything good or bad can happen at any time so it's best to be prepared for disaster. I wouldn't be surprised if within the next month (or even week) that silver crashes to fifteen an ounce and that gold goes to 1500. My gold mining fund could easily decline 20% or more from here. The broader stock market - Why not another Great Depression where the market crashed almost 90%? Will the government nationalize my mining and global resource funds? Again, why not? Will they attempt to outlaw or even confiscate my gold and silver coins? I really wouldn't be surprised at anything that happens. I am not leveraged on any of my investments, so even if the prices go way down I know that it will be temporary and I might even be able to pick up more coins and shares on the cheap. What are your worst case concerns?

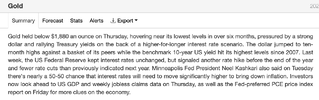

am watching , watching , watching at worried it is a sign of liquidation of 'winners by those who use a lot of leverageSomewhat surprised by recent weakness in Gold price as didn't expect it to dip as much as it has done so (on strengthening USD & ongoing inflationary pressures).

Perhaps a blessing in disguise/yet another opportunity to load up on precious metals here imo

Is there any hope that the past week's pause is actually a longer term pause and potentially a floor?

What do we need for a reversal?

Attack on Israel could boost appeal of gold, safe haven assets

Reuters

October 8, 2023 1:10 PM GMT+1

Https://www.reuters.com/world/middl...ost-appeal-gold-safe-haven-assets-2023-10-08/

Rising geopolitical risk could see buying in assets like gold and the dollar and potentially boost demand for U.S. Treasuries, which have been sold off aggressively, analysts said.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.