- Joined

- 19 October 2005

- Posts

- 4,178

- Reactions

- 6,152

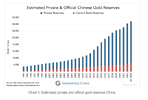

Years ago, forget how many, the CCP very strangely began encouraging its citizenry to save in gold and silver.

It's dollars to donuts imo that the boundlessly evil CCP will force private gold holders to exchange their metal for paper some day and that was their stinking plan all along.

It's dollars to donuts imo that the boundlessly evil CCP will force private gold holders to exchange their metal for paper some day and that was their stinking plan all along.