- Joined

- 29 January 2006

- Posts

- 7,222

- Reactions

- 4,452

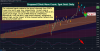

Within the past 20 minutes gold dropped $18 in a 10 minute stimt, so maybe someone is pressing all the elevator buttons:

Clearly gold is already heavily over-extended, having obliterated the upper band of an already optimistic trend channel.

I will be very happy to see gold back into the $1800s for much needed consolidation, but there could be a lot of punters worried about missing the boat, and keeping the price unsustainably higher for longer.

Clearly gold is already heavily over-extended, having obliterated the upper band of an already optimistic trend channel.

I will be very happy to see gold back into the $1800s for much needed consolidation, but there could be a lot of punters worried about missing the boat, and keeping the price unsustainably higher for longer.