- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

nearterm, xauusd on a very clean set of sells

price hit the uptrend line and stopped selling .....that's wot ya call bullishnearterm, xauusd on a very clean set of sells

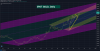

Back on 21 May I plotted an alternative Elliott Wave count because I could not see the technical correction panning out as some others had described.@gartley - Here's how I see the wave count work better (my count is golden):

My view is that the count window in your chart is time constrained and the impulse waves are therefore not properly accounted for.

Underlying my count is the preferred trend channel I use to preempt future prices. I place wave 3 terminating in the plus$1800 window which I have shaded, above.

Excellent comment @rederob .I have charted the last month's price action in a way to look like sheet music for gold bugs.

The buy signal in my previous chart got hit but, alas, "above the line:"

What is not immediately obvious is that from left to right we cover an $80+ range in 30 days.

What's nice to not see is the markets raving about gold, as despite being at 8 year record highs its incremental daily movements have been relatively subdued, as reflected in a steady day to day trading volume pattern.

I think I would be watching silverl now be following this thread....

I do and up almost 6% for today, gold off to the races also.I think I would be watching silver

One has to ask oneself, if one were living in the Middle Ages and there was a Plague, what commodities would increase in value?It’s safe to say that both gold and silver are looking very bullish.

The Euro stimulus package announced yesterday has given the precious metals futures a decent shot in the arm.

This is just the beginning however I think we’ll see a decent rush with similar stimulus packages to be announced in months ahead particularly leading up to the US election.

The gold miners will have a good day ahead as the futures have now broken 1840.

Where are we heading? I don’t think 2000 is out of the question by year’s end.

https://www.barchart.com/futures/qu...T&sym=GCQ20&grid=1&height=500&studyheight=100

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.