- Joined

- 8 June 2008

- Posts

- 13,759

- Reactions

- 20,562

My orders might go thru..been waiting for a while

Start of the crash we needed to have?gold might be a bargain soon

My orders might go thru..been waiting for a while

Btc etf purchased.My orders might go thru..been waiting for a while

Start of the crash we needed to have?gold might be a bargain soon

The Bank of England that coordinates the multi-decade London price rigging of silver and gold in London is going to have a very rough time in the weeks and months ahead.Silver vault stockpiles in London and Switzerland are thus going to see growing demand for added silver delivery to the US market to make up in-part for the tariff penalized silver supply from Mexican and Canadian miners.

As noted over the last several months, London’s vaulted silver stockpiles are already at a critical level where very little of the silver in London vaults is available for delivery to provide liquidity to the physical silver market.

With an estimated 4 billion (B) to 6B oz. of only fractionally-backed silver promissory notes for immediate silver delivery issued into the London cash/spot silver market, some market participants will begin to default if reallocation of added silver delivery demand to London continues over time.

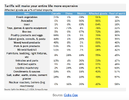

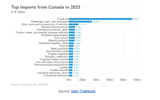

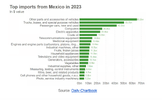

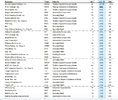

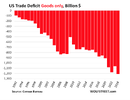

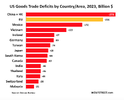

Numbers are always interesting, past the outraged crying of our biased media, especially compared to Australia.Everything you could possibly want to know about tariffs

View attachment 192636View attachment 192635View attachment 192634View attachment 192633View attachment 192632View attachment 192631View attachment 192630View attachment 192629View attachment 192628View attachment 192627View attachment 192626View attachment 192625

DOGE

If Musk's DOGE succeeds in its efforts to seriously reduce federal employment, it would likely be enough to ding the overall U.S. labor market — but just create a little dent.

The big picture: Given the massive U.S. economy, even hundreds of thousands of people potentially losing their jobs isn't enough to significantly move the overall unemployment rate.

By the numbers: The federal government employed 3 million people in December, per the Labor Department, but if you exclude the Postal Service and military, that number is 1.85 million.

- But the impact on specific locations — the Washington, D.C., metro area in particular — could be greater.

The intrigue: It is a reminder of just how massive the U.S. labor market is. In December, 2.6 million Americans quit their jobs and 2 million were fired. A few hundred thousand government workers quitting or being forced out would only temporarily increase those numbers.

- If the Trump administration were to cut 20% of those jobs through buyouts, firings or pressure to quit, that would result in 370,000 current government employees out of work.

- If every single one of those people were counted as unemployed, it would be enough to push the national unemployment rate to 4.3% from its current 4.1%.

- However, that's an unreasonable assumption, because many of those discharged employees would either retire (and thus no longer be part of the labor force) or quickly find new jobs. So the actual impact on headline unemployment would likely be lower.

Of note: The economic impacts of large-scale federal job cuts on specific geographies are likely to be higher.

- It would, however, be a big change from the norm; federal government employment is traditionally very stable.

- In December, only 7,000 federal employees were laid off or fired, and 11,000 quit. Look for those numbers to go way up as 2025 data is released.

What they're saying: "It is too early for these to affect the January numbers," wrote BNP Paribas economists in a note. Employment numbers due out Friday cover a period before the inauguration.

- In the D.C. area, 11% of all jobs are with the federal government.

- If the Trump administration eliminated 20% of D.C.-area federal jobs and all of those people became unemployed, the local unemployment rate would nearly double to 5.5%, from its 2.8% December level. (But given the caveats above, the actual impact would certainly be lower than that.)

- "That said, [the buyouts] suggest net downward pressure on federal employment over time," they wrote.

jog on

duc

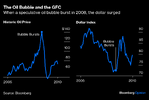

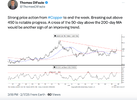

| We've discussed this all year. What's the catalyst to send stocks and other risk assets ripping in the first half of the year? It's the U.S. Dollar. I continue to be impressed with just how resilient stocks have been, despite the Dollar's relentless bid over the past 4-5 months. And now here we are, with so many people crying all weekend about something they call "tariffs", and they're slamming the Dollar. It's all happening right at the 61.8% retracement of the entire '22-'23 decline. Do you think that's a coincidence? I do not. |

| When it comes to the stock market, we always like to do a sum-of-the-parts analysis, whether it's the S&P500, or Dow Industrials or NYSE components. We call it market breadth. We go through the exact same process in forex markets. If you think that the US Dollar is going to fall, sending stocks and other risk assets souring, then you'll need to see a bid in other forex markets. We can go one by one if you want. But I brought 2 important ones with me that I think are about to rip, confirming the US Dollar weakness. Here's the Canadian Dollar breaking below former support, and quickly reversing all those losses. This is a classic reversal pattern. So if you're bearish the US Dollar (and bullish stocks), you're looking for upside follow through here in CAD: |

| Every time the Canadian Dollar has gotten down to these levels over the past decade, they've come in and bought them. Is this time like those other times? I think it is. And we're seeing something similar in Brazilian Real. You see that break below the Covid lows, and then a quick reversal? From failed moves come fast moves in the opposite direction, is how I learned it. I think the BRL is set up to do exactly that. |

| How do you think risk assets are doing if the Brazilian Real is ripping this year? I got a text message from Steve yesterday, "Bro, Dollars getting slammed. What goes up the most if dollar gets wrecked?" In this text he's asking me as a joke. Him and I both know that he very much knows the answer. Here's what he's watching and why... |

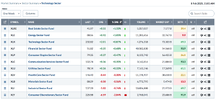

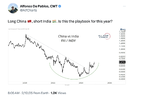

| From Steve.... I think it's impossible to have enough exposure to China right now. I absolutely love the setup over there. Chinese equities have seen a relentless bid in the face of all this trade war news over the last few weeks. A couple of months ago, we put a bullish bet on the iShares China Large-Cap ETF $FXI. Our calls more than doubled in value, allowing us to lock in gains and ride the remainder risk-free. Today we’re adding more long exposure, extending our time horizon, and giving this trade some extra time and space to play out. |

| While FXI has spent the past two months in a corrective phase, price is back at the upper bounds of this reversal pattern. A breakout here will confirm a new uptrend is underway. I think it is coming any day now. Let’s get long more calls in anticipation of it. |

| When President Trump demanded lower interest rates two weeks ago, it looked like a return to his 2018-vintage Fed jawboning. But his administration's stance on interest rates now looks more subtle. Why it matters: The new administration seeks to bring long-term interest rates lower, Bessent said yesterday — and Fed rate cuts aren't necessarily the way to achieve that.

Between the lines: Trump has no compunction about bashing the Fed when it is running monetary policy tighter than he would like, as in 2018. But that is not the current stance of his administration.

|

Budaghyan estimates that federal spending needs to come down by 3.6% if Bessent wants to stabilize the ratio of public debt to GDP. That’s politically infeasible and would need to be passed by Congress. Here is his math:To escape the inflation rocks (i.e., prevent a bond market riot), Bessent needs to persuade Trump and Congress to cut fiscal spending. Critically, fiscal cutbacks should be large enough to please the bond market. However, if the fiscal cutbacks are too large, they will cause the ship to veer off course and crash into the recession rocks. Can the Trump administration cut fiscal spending just enough to bring down US bond yields but not cause a recession?

| The U.S. labor market started 2025 — and President Trump's term — in a state of uncanny balance. Why it matters: Unemployment is low and steady, and job growth is chugging consistently forward. It's an environment that allows policymakers at the Federal Reserve and beyond to be patient in deciding what to do next.

|

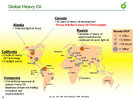

Here, courtesy of this fascinating piece from Business Insider is what some shale oil from the Dakotas looks like.Most American refineries are set up for the kinds of heavy, sour crudes you get from Canada, Mexico and Venezuela. That made sense when it looked as if the US was running out of domestic oil, but then came the shale oil revolution. American shale oil, it turns out, is typically light and high quality, meaning it is not best-suited for domestic refineries. The upshot is that while arithmetically America is energy independent – producing far more oil than it consumes – in practice it is anything but. It must keep sucking in heavy oils from elsewhere to feed its refineries while sending Texan crude off to Europe and Asia to be refined.

|

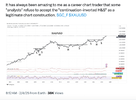

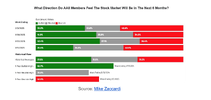

| It's hard to imagine what it is that these investors are all so bearish about. I mean, we're in the middle of a bull market, where we know historically it pays way better own stocks than to be selling them. We know. We have the data. And yet, accordingly to the latest AAII survey, more individual investors are bearish over the next 6 months than at any point since November of 2023. Here's what stocks have done since then: |

| These are historic returns that have rarely been seen throughout stock market history. It's been practically straight up. The S&P500 is up almost 40%, while the Nasdaq100 is up over 45%. Financials and Communications are each up over 50%.Consumer Discretionary, Industrials and Technology are also major leaders during this period. You see, stocks don't go up or down in price based on "fundamentals". Prices move based on positioning. And when individual investors are all bullish, it's probably a good time to be selling. More importantly, and definitely more actionable, is when individual investors are bearish. That's historically a great time to be buying very aggressively. These are the worst investors on the planet, and they're the most bearish they've been since 2023! If you own stocks and are looking for higher stock prices, this is music to your ears. If you're bearish and think stocks are going to fall, well, the dumbest money on the planet certainly agrees with you. I can't imagine what these folks are so bearish about. They likely watch too much news and got caught up in these bull**** headlines about the deepsack or something they're calling "tariffs". As investors, we have a choice. We can follow the news cycle, which is specifically designed to distract you from what is important. Or we can follow price, which is the only truth in this matter, and also happens to be the only thing that actually pays anyone. It's up to you. We're taking full advantage of all this unwarranted pessimism and we're buying stocks. It's the only responsible thing to do as an investor. Yesterday alone we had 3 China trades double. Of the 8 China trades we've put on since the election, 6 of them have at least doubled in value, and one of those remaining 2 is already up 50%. This is the type of market we're in. |

| 1 big thing: A new inflation surge |

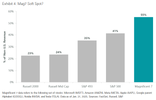

Data: Bureau of Labor Statistics; Chart: Axios Visuals Inflation surged ahead to start 2025, crimping Americans' buying power and serving as a warning to policymakers — whether those contemplating new tariffs or further interest rate cuts — that price pressures are not yet vanquished. Why it matters: Economic policymakers have described the disinflation process as a bumpy road. The past six months instead look like an uphill path.

|

President Biden and a Democratic Congress took power in 2021 with a bold plan to propel the nation out of the pandemic, revitalize American industry and bolster the working class.

|

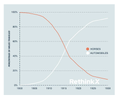

| The North American trade drama is unfolding against a backdrop of diverging economic performance that gives President Trump leverage in the trade war. Why it matters: The two nations are tightly linked by the trade patterns that the White House threatens to blow up.

|

|

|

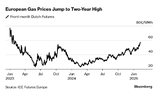

We have plenty of coverage of what Trump announced. From now on, he’s levying reciprocal tariffs on all trading partners; any tariffs other countries put on the US will be matched one for one. This is over and above specific strategies, such as the already-announced plan to put tariffs on aluminum and steel, and future levies on chips, cars and pharmaceuticals. It will also go beyond tariffs per se and cover value-added tax, such as is levied across the European Union, and in many other places. That’s not a trade sanction as such, but can have the effect of raising the price of imported goods. To show that he really meant it, Trump admitted in as many words that this would probably mean higher US inflation in the short term, although he was confident the measures would eventually pay for themselves. In the current climate, that was a big admission and showed that he was prepared to lead the US electorate into making sacrifices; much more serious than had previously been expected. However, there were no dates, no specifics, and he didn’t even sign the by-now-customary executive order, instead merely signing a memo directing others to work on it. The Oval Office meeting had been well-trailed in advance. Here is how some of the main US markets moved through the day, and how they reacted to the comments:  Equity volatility dropped once the meeting started, while the major US indices started on a tear that carried on until the close. The dollar directly gains from tariffs as foreign exchange traders try to counteract the effect on its competitiveness. Yet it spiked only briefly as the meeting started — then tanked. The gold price suggested investors in that market were more concerned at day’s end. But other than that, this was an emphatic cross-asset judgment that the president had meant the opposite of what he’s said. How to explain this? Bond yields fell early in the day in response to data that suggest the Fed’s preferred inflation metric will be lower than thought, which helped stocks — but it doesn’t explain the big changes in direction once the president had spoken. It’s possible to argue that behind the bluster, the detail was more conducive to compromise than had been feared. Mike Reynolds, investment strategist at Glenmede, said: It’s also possible to argue that the whole thing lacked credibility. This was the first response of Peter Tchir of Academy Securities: Those stocks with most to lose from a trade war tended to gain most. The Magnificent Seven companies are hugely globalized, as this chart from Jeffrey Schulze, head of strategy at ClearBridge, demonstrates. They are now close to their all-time high from last year:  The weaker dollar will make their overseas earnings look that much better. This fits a broader pattern. Goldman Sachs’ US equity strategist David Kostin keeps separate indexes of the US stocks that gain most and least of their revenues from overseas. Domestic-focused stocks should outperform during a trade war. But since the election, after an initial rally, they’ve lagged a bit:  How to explain this ongoing market reaction? For all the threats, Trump is plainly fishing for concessions from others. If he wanted to go ahead with a simple blanket tariff of 10%, and mimic his idol President William McKinley by funding the Treasury with tariffs, he could do that, but he’s choosing not to do so. Marko Papic of BCA Research argued: The future remains messy. It’s tempting to break it down into two green-tinged scenarios. Either Trump is the Wizard of Oz, manipulating reality behind the curtain when there’s nothing there, or he’s the Incredible Hulk, who will soon shock everyone by bursting out as the terrible Tariff Man. The reality is somewhere between the two, and there is much money to be made and lost between the extremes. At present, the market’s bet that Trump is the Wizard of Oz looks over-confident. He has a mandate to reverse globalization, he plainly believes in it, and he won’t win meaningful concessions unless he goes through with serious trade levies at least once. |

| Yesterday we saw the Nasdaq100 close at new all-time highs, on an equally-weighted basis! I keep being told that market breadth is weakening, mostly from people who haven't even bothered to count. So let me ask you... Is the equally-weighted Nasdaq100 closing at the highest level in its entire history evidence of broadening strength, or a weakening market? |

I'm old enough to remember when they were telling me that this was all just a "bear market rally" and that we shouldn't be buying stocks. Then it was, "Only 6 stocks going up", so we shouldn't be buying stocks. Now they're telling me that market breadth is weakening, when it's actually broadening, and that we shouldn't be buying stocks. You know what we've been doing this entire bull market? We've been buying stocks, and laughing about it along the way. You've had a front row seat to it all. And this was just while it was mostly U.S. stocks doing well. Now we're seeing broadening participation all over the world, with areas like Latin America hitting new multi-month highs, Europe hitting all-time highs, and now Southeast Asia really getting going Here is the Global 100 Index also going out yesterday at new all-time highs: |

Here's the life hack: Just put in the work. You don't need any fancy algorithms or complicated calculations. You just have to go and count, one by one, and actually weigh all the evidence. It's not hard. But it's the best way to do this. I can tell you for a fact. And so when the weight-of-the-evidence points to getting aggressive and maximizing the opportunity in front of us, that's where Breakout Multiplier comes in. The Breakout Multiplier System was specifically designed for times like this, to take full advantage of the bull market we have in front of us. |

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.