- Joined

- 28 December 2013

- Posts

- 6,387

- Reactions

- 24,311

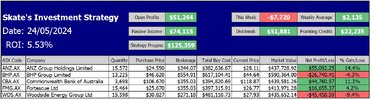

One Investment Suggestion is to "Buy the ASX20"

ASX20 Index Investing - A Flexible and Consistent Approach

The simplicity of this investment strategy lies in its flexibility as you can start at any time. Whether you begin with $100,000 or a different amount, the percentage return remains consistent. Beyond annual rebalancing, there’s little else to manage. This type of investment strategy allows you to enjoy the fruits of your well-executed plan for many years to come.

Explore the potential of ASX20 Index Investing

By distributing your trading funds among the top 20 companies listed on the ASX, you’re not just diversifying your portfolio, you’re also tapping into the market’s fluctuations at the top end.

Embrace Market Movements

When you invest in the entire index, you embrace the ebb and flow of natural fluctuations, celebrating gains and weathering losses. It’s a total approach that mirrors the full spectrum of the ASX20.

Equal Weighting - Stress-Free Investing

By allocating equal weight to all positions, you eliminate the pressure of selecting individual winners. This straightforward strategy simplifies your investment approach.

Unseen Benefits - The Complete Picture

The graphic below captures the capital gains, yet it’s just the beginning. When you factor in Dividends and Franking Credits, these additional benefits significantly increase your returns. This method doesn’t just outshine traditional banking investments, it also showcases the intrinsic value of placing your trust in established, reputable companies.

Annual Rebalancing - Keeping your Portfolio Aligned

Maintain the harmony of your portfolio by conducting an annual rebalancing on the 12-month anniversary. This disciplined practice ensures that your investment stays in step with the evolving index composition.

Skate.