- Joined

- 20 July 2021

- Posts

- 12,716

- Reactions

- 17,668

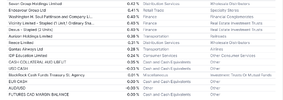

i thought you might ( and agree it is rational, to my mind )@divs4ever, commencing with the new financial year on July 1st, 2024, I’ll be adopting a different strategy. The dividends and franking credits from my portfolio will be channelled towards creating a reliable income stream.

the other logic was adding to your losers , but that would mean an awkward weighting

but July is a month ( and a bit ) away , there is still time for fire-works

cheers