- Joined

- 28 December 2013

- Posts

- 6,387

- Reactions

- 24,311

This comment was referring to posting signals ahead of time that you are entering

After reading the ASIC guidelines I have decided to cease this practice but thanks for the heads up.

Skate.

This comment was referring to posting signals ahead of time that you are entering

After reading the ASIC guidelines I have decided to cease this practice but thanks for the heads up.

Skate.

so it appears Nick does not have his own Australian Financial Services Licence but operates under SWM.

After reading the ASIC guidelines I have decided to cease this practice but thanks for the heads up.

Thanks for your reply. I didn't listen to the interview and really don't have time to spend on listening.Thank you for your response investtrader.

I wrote:

"I knew nothing of Nick Radge so Google led me to his site and then to an hour and a half Q&A podcast in a series "Chat With Traders" 178. The Blueprint: How To Create A Simple Trend Following System.

Nick came across as a pleasant personality and I took a few notes as he discussed his methods."

Hardly "piling on". My comments about the podcast were mostly quite positive apart from the one you are upset by!

"Piling on" is a complete exaggeration.

And I took several pages of notes as well as he had some useful things to say.

I gave the location of the interview for anyone else to check the accuracy of my reporting and I listened to it more than once.

Did you actually listen to the podcast?

I stand by my reporting, I did not write "clearly incorrect statements".

You are making reference to something elsewhere Nick Radge may have said whilst I referred to a very specific interview viz 178. The Blueprint: How To Create A Simple Trend Following System which is available online for all to hear hence I reject your assertions.

@entropy Thanks for the background - very interesting. I just read about it on Wikipedia.Thanks for posting investtrader!

Brought smiles from me and some fond memories.

This Dozsa character's skit is sending up of course the original Dozsa, the late Paul Dozsa.

Older chessplayers on this forum may remember him as the notorious Hungarian chess master who emigrated to Australia and made a name for himself as a serial pest and freeloader who wanted to get into the Guinness Book of Records as the world's biggest freeloader.

His specialty was to eat and drink at upmarket restaurants then decamp without paying.

Did a few stints in jail for his actions. Had a few stints on television.

Another guy I knew, Frank Lilly, was his manager in negotiations for fees to be interviewed, I kid you not!

I once played chess against him in a tournament at St George Leagues Club in Sydney ( he beat me).

A larger than life, bizarre, character with aristocratic pretensions. He told me that he did military service in Hungary and a chip was implanted in his brain by military intelligence as an explanation of his strange behaviour, he was being manipulated from Budapest!

The actor does a good impersonation of Paul.

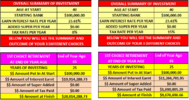

Talking about the FFX chart, another one is the impossible 20M equity curve promoted excluding any tax and comparing it against the index.

The compounding effect of paying zero tax would be massive over 25 years.

Not even considering the pitfalls of a 25 year backtest, I wonder if this is something that could be taken as misleading. I doubt it would but that 20M equity is something to behold and suck in newcomers.

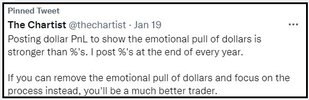

most folks focus on $$ not percentage of portfolio. A $500k drawdown doesn't get any easier to accept just because it might be 10% to 20% of your portfolio. Humans are humans and even Nick R is a retail trader so that's still tough.

Tax was only 1.7 Million but his account dropped over $10 Million.

Not sure what's going on here, however, taking something from the private part of the forum and posting it in the public section?Reposted without permission

Hi @Skate,

You might want to review and amend the table you posted (ref. post #7236).

The month of Feb is where the problem starts.

Cheers,

Rob

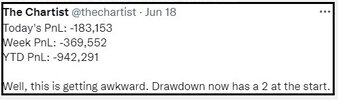

Not that it makes too much of a difference in the long run, but his reported result on the 18th is incorrect.

View attachment 144182

Are they ploughing or plugging away?I still find it incredibly grounding and constantly grateful that Nick, Peter2, Skate and others share candid trading results through such a tough 12 months. It would be so tempting for most traders to go back to the drawing board and fiddle in such tough times. So great to see "pros" plugging away consistently.

I still find it incredibly grounding and constantly grateful that Nick, Peter2, Skate and others share candid trading results through such a tough 12 months. It would be so tempting for most traders to go back to the drawing board and fiddle in such tough times. So great to see "pros" plugging away consistently.

Are they ploughing or plugging away?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.