- Joined

- 17 October 2012

- Posts

- 707

- Reactions

- 1,389

Gee, its going to be tough getting a statistically significant backtest for so few trades over such a long timeframe DaveTrade.

Gee, its going to be tough getting a statistically significant backtest for so few trades over such a long timeframe DaveTrade.

Do you have to be a member - where is the offer listed please?Hi All

FYI radge is offering 50% off his turnkey systems. Nov 26-29. Thought I’d put it out there in case someone was thinking about it.

No, I don’t think have to be a member. He sent an email out this afternoon. He said “stay tuned for more information”. I’ll PM you once he sends more details.Do you have to be a member - where is the offer listed please?

Received email this morning from The ChartistNo, I don’t think have to be a member. He sent an email out this afternoon. He said “stay tuned for more information”. I’ll PM you once he sends more details.

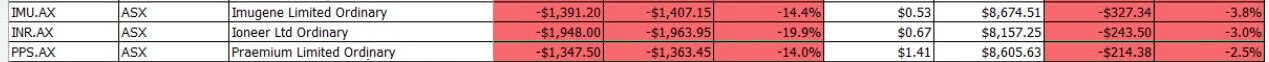

Dammit Skate, you must be running a more aggressive trailing/stale stop for winning trades in tough markets and giving the losers a bit more room to run!?

Must compute, new data, must compute........

It's our human nature, knee jerk reaction to the hammer knock.The flash-crash on Friday was horrendous to all system traders

Trading at times can be downright annoying because we are not immune to a sudden shift in market sediment. The markets do change but the underlying rules for success don’t seem to. It is still driven by the same two opposing forces, fear, & greed. Companies have not changed since Friday, & now it's all systems go today. Trying to figure all this stuff out can be frustrating.

Let's not try to make trading complicated

Using logic to figure what the market might do on any given day is a waste of time in my opinion. Over-thinking is an overrated attribute when it comes to trading. Smart people tend to think logically & have a hard time dealing with a market that ignores what should be painfully obvious. The market is illogical at times & if you are too analytical, you will be surprised often.

Skate.

What a wise saying in your first paragraph. Will change some wordings but keeping to your wise idea n sending it to serious gamblers, hoping to save some souls.Why do traders lose at trading?

The answer is that we are humans not machines. When it comes to trading you need to be clinical, "resist being emotional". Trading emotionally makes us trade irrationally. We are not wired to trade successfully. To overcome that weakness you have to have a system in place or a trading strategy. Having a system or strategy to trigger an action without debate adds value & allows you to sleep at night.

There is nothing new when it comes to trading ideas

There has been a debate over the last few months about the usefulness of a backtest. The differing opinions relate to the time period of a backtest to achieve meaningful results "is the contentious issue". Personally, I favour test results over the last 4-5 years because to "me" it offers a more reliable evaluation framework. Backtest over a longer-term period often spanning 15-20 years as far as I'm concerned becomes less relevant to trading in these difficult times. System traders would be better served concentrating on the process that adds value to the portfolio than anything else.

Skate.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.