- Joined

- 2 August 2016

- Posts

- 897

- Reactions

- 1,492

Oh I love this thread because I am going to disagree with @Skate and many others on this point until the day we die.

Oh my. Where do I begin. Let me see if I can put this in point form to make it easy for readers to digest.

The backtest period is important.

You should be concerned about long term backtests. Usefulness in the short-term is irrelevant. You want to design a system that performs well over a long data set. You cannot code a system to perform well in all market conditions. That's why I want something that performs exceedingly well over a long period of time, that is hard to stomach. Because no one in their right mind would want to be there trading a system that can produce 40%+ drawdowns and has infrequent profits. But, this is the way to make money in the markets.

The more entry and exit conditions you code into a system in addition to optimising your parameters over what I consider to be a miniscule to minimium amount of data, the more you are treading the path of robustlessness.

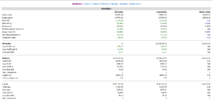

Can someone please just humor me and put up a backtest of their system that is optimised to recent data and post a up backtest since 1992. I'd love to see it. Let's do it in the name of transparency.

I will never understand the idea of over-optimising your systems to say, 1-5 years worth of data under the guise of oh, "the markets have changed". Yes, the markets have changed, but human behaviour has not.

The backtest period is important

When you concentrate too much on long term backtests metrics to construct a strategy its usefulness in the short-term can be stifled. Performance results can be like “chalk & cheese” when conducting an evaluation over massive time frames. Performance observed in the past may offer little insight into the strategy performance in the short term. All I'm saying, markets have changed over the last 20 years.

Skate.

Oh my. Where do I begin. Let me see if I can put this in point form to make it easy for readers to digest.

The backtest period is important.

You should be concerned about long term backtests. Usefulness in the short-term is irrelevant. You want to design a system that performs well over a long data set. You cannot code a system to perform well in all market conditions. That's why I want something that performs exceedingly well over a long period of time, that is hard to stomach. Because no one in their right mind would want to be there trading a system that can produce 40%+ drawdowns and has infrequent profits. But, this is the way to make money in the markets.

The more entry and exit conditions you code into a system in addition to optimising your parameters over what I consider to be a miniscule to minimium amount of data, the more you are treading the path of robustlessness.

Can someone please just humor me and put up a backtest of their system that is optimised to recent data and post a up backtest since 1992. I'd love to see it. Let's do it in the name of transparency.

I will never understand the idea of over-optimising your systems to say, 1-5 years worth of data under the guise of oh, "the markets have changed". Yes, the markets have changed, but human behaviour has not.