- Joined

- 8 June 2008

- Posts

- 13,691

- Reactions

- 20,394

I use open trade profits as well , but with high churnout, probably not as different as it would be if i was rarely selling buyingI think this is only an issue if we look at drawdowns as something we must try and limit or avoid. I prefer to reframe drawdowns as a combination of actual closed trade equity drawdown and open trade equity fluctuations. The open trade equity profits aren't mine as I haven't closed the position and the only way to catch large outliers, which will increase my CAGR over time, is to let those open trade profits fluctuate.

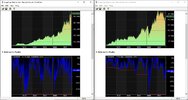

As trend followers we might look at a chart of a stock and accept that the stock won't go up in a straight line and therefore, we need to accept some profit giveback in order to catch the overall larger trend. I remember listening to a CWT podcast with Nick where he talks about a dymanic trailing stop - 40% when regime filter is up, ratcheting up to 10% when the regime filter turns down. Well, I see my equity curve as the same type of thing. My equity curve isn't going to go up in a straight line, it will zig and zag, it will pull back, it will consolidate and go sideways, however if I stick to my system and take the trades my system tells me to, I can expect that I will create the longer term up trend of my equity curve, albiet with short to medium term return volatility.

I need to give my equity curve room to move in order to create the long term trend of my equity curve.

It's so interesting to me that the focus is on reducing drawdowns and not maximising returns. I know everybody has different risk tolerances and capital preservation definitely becomes an issue the closer we get to retirement, however I am sceptical of these short term backtests showing incredible returns with minimum to minuscule drawdowns. @Skate the monthly systems are not run on monthly data as shown in your backtest results.

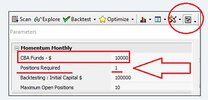

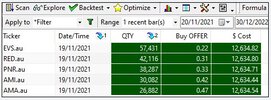

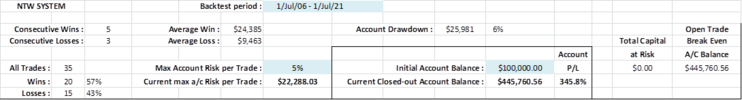

So, I ran the system I will be using in my SMSF, which is a modified version of Nick's 'Large Cap Momentum' strategy on the XAO with a maximum of 10 portfolio positions and we get the following results:

Backtest period: 01/01/1993 - 21/11/2021

CAGR: 37.13%

MaxDD: -62.84%

This is the most interesting bit for me and one of the reasons I stuck with the ASX100.

View attachment 133185

In April of 2000 you had to put up with a -51.9% month. I know people are going to say it doesn't matter because that was over 20 years ago - but it does matter because it is a result that the system has produced before which means it is now within your systems expected results.

Actually, my testing shows that for this strategy, the thing that strangles returns the most is the using a regime filter.

I am trading the ASX100 for my SMSF system.

Once again, I think if you're taking the view that open trade profits are yours and you're trying to defend every equity high, then you're going to have to problems living with drawdowns.

Here is a question for everyone concerned about defending equity highs. When you position size, do you do it off original equity plus/minus closed trade profits and loses only or do you position size off your open trade profits as well?