- Joined

- 13 February 2006

- Posts

- 5,427

- Reactions

- 12,686

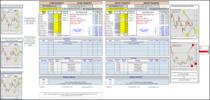

The other thing that I’ve only mentioned once on the forum, and I think that may have been in a conversation, is that I intend on trading the A$-US$ as another market in this system, to act as a currency hedge. The difference is it wouldn’t really be a hedge because a hedge is something you lose money on, it will be a trade to make money and provide a currency hedge while doing it. I hope this post fills in any questions like ‘what the f* is this guy talking about’.

Currencies can be tricky.

The point though was more related to 'hedges'.

Hedges, if correctly implemented, are value adding (additive) to portfolios over time. Mark Spitznagel has a recent book on this subject (Safe Haven).

I would argue that at current valuations (Stocks, Bonds) hedges are critical to mitigate the really elevated risks generated from extended valuations and the current macro-environment.

There are (obviously) a number of ways of adding hedges to your portfolio.

jog on

duc