- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

Wimps

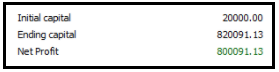

In fact, I’ll go so far as to claim that a smart wimp who runs and hides when the going gets tough generally produces better results than brave souls who are proud of their ability to suffer great monetary pains while they wait for their convictions to be rewarded. The problem with the “macho” approach to the markets is that the consequences of being wrong are so onerous. The stronger your convictions and beliefs, the more invested and braver you are, the greater the chance for a backbreaking loss. The wimpy trader knows that the key to success is staying in the game for the very long term.

@peter2 it's those with the experience that make the most sense. The secret in this game (since COVID) is to grab profits & cut your losses quickly. By cutting those losses quickly results in a lower drawdown with increased profits. (of which you are an expert BTW).

Weekly system traders don't enjoy the luxury of exiting early during midstream

Systematic trend traders need to have this added layer of protection coded within their buy condition & sell strategy (so you don't buy false breakouts whilst ensuring you exit quickly as possible). With a low 36-45% strike rate the exit strategy has to be sharp & responsive. Any stalling of momentum is good enough for me to pull the pin. Relying on a two-stage trailing stop just won't cut it these days. Also, drawdowns don't hurt as much when you are playing with their money. Getting deep into profits is the tricky part of trading.

Skate.