- Joined

- 13 February 2006

- Posts

- 4,996

- Reactions

- 11,218

For 2024, I'll do month by month.

Wrapping up 2023:

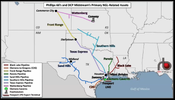

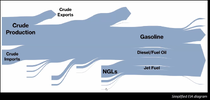

Oil which will remain and increasingly grow more critical moving into 2024:

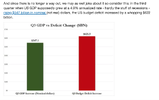

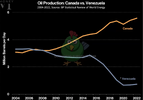

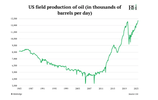

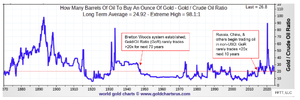

Shale needs higher prices than Russian or Saudi oil. Much higher prices. If prices fall, production is cut and the recoverable oil falls precipitously. As can be seen from the data.

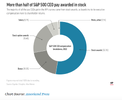

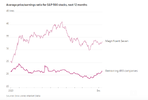

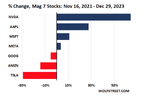

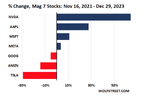

Can't have the Mag. 7 fall to the Fab. 4. Bear markets invariably have narrowing participation driving the market higher.

jog on

duc

Wrapping up 2023:

Oil which will remain and increasingly grow more critical moving into 2024:

Shale needs higher prices than Russian or Saudi oil. Much higher prices. If prices fall, production is cut and the recoverable oil falls precipitously. As can be seen from the data.

Can't have the Mag. 7 fall to the Fab. 4. Bear markets invariably have narrowing participation driving the market higher.

jog on

duc