- Joined

- 13 February 2006

- Posts

- 5,056

- Reactions

- 11,454

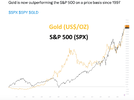

According to the Fed, the economy is strong. No sign of weakness.

Ok, so why cut 50bps with more widely expected to come? Is it because you can't cut 'entitlements' (Medicare, Medicaid, Social Security) and you won't cut defence spending? So to continue deficit financing, you cut interest rates. LOL.

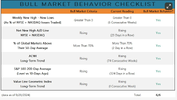

Only really semi's holding the market to moderate losses.

jog on

duc