- Joined

- 8 June 2008

- Posts

- 12,773

- Reactions

- 18,677

"Sectoral alphas after rate cuts"

Surprised that energy could do bad as a result of rate cuts.

Could it be more: energy rises, inflation rises, when energy is going down, rates can be cut...

So rates are cut when energy goes down.

That was the world before.

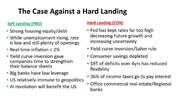

Now, if we cut rates because the US is going broke, that might be a bit different

Surprised that energy could do bad as a result of rate cuts.

Could it be more: energy rises, inflation rises, when energy is going down, rates can be cut...

So rates are cut when energy goes down.

That was the world before.

Now, if we cut rates because the US is going broke, that might be a bit different