- Joined

- 28 December 2013

- Posts

- 6,360

- Reactions

- 24,242

I have re-numbered your post to address the important points.

1. You are essentially citing the 'Efficient Market Theory'. Which has been thoroughly disproven.

2. Here you contradict yourself from your position above. Either the market is efficient or it isn't. Your new position is that it is nearly (mostly) efficient. You state that: financial statements may not always accurately reflect its true financial health but in the next breath state that a skilled analyst rarely identifies this fiction.

3. You move from your assertion of efficient markets to non-efficient markets and state that system trading can identify opportunities that may not be readily available through fundamental analysis.

I find this last statement bizarre.

From the 'Dump it' thread, we have been provided any number of mechanical systems that have been developed.

I have not seen any system that is much above a 50% win rate. Which essentially requires tight money management techniques to make it profitable. Not the initial stock selection.

The point being: system trading cannot identify superior trading opportunities to (good) fundamental analysis. Pure nonsense. There are so many more objections to this point.

Returning to point #2: I agree that financial statements may not reflect true financial health. I would take it further and state that financial statements rarely represent the truth. Some fictions are more dangerous than others. Fraud can be hidden by clever legal language, but it remains morally fraud perpetuated by management. Skilled analysts do regularly pick this up. Due to warped incentives (buy side being far more important than sell recommendations) these are rarely promulgated widely.

But your post goes a long way to explaining your nonchalance to posted fundamentals and comments re. you current portfolio, specifically banks, which are de facto black boxes with huge off balance sheet liabilities.

Banks:

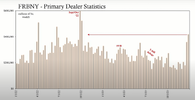

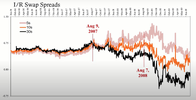

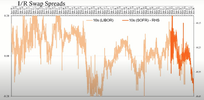

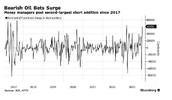

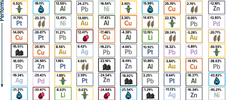

View attachment 168518View attachment 168517View attachment 168516View attachment 168515View attachment 168514

Notice the word 'depositors' not 'investors'. Investors went to $0.00. They were wiped out. Did the 'technicals' warn? No.

There were however analysts that were making noise about the fraudulent reporting. They were pretty much ignored.

The question then becomes: how is the 'investment' managed?

ANZ and CBA both carry significant derivatives positions, only partially disclosed in the financials. Could they potentially blow the bank up? Absolutely. Buffett had enormous issues with General Re. and its derivative book. It took him a couple of years to unwind it with heavy losses.

So is it managed on the fundamentals, which you simply have no idea on or the technicals?

If the technicals, fine. No issues.

But then it is not 'fundamental' investing. It is simply a longer term technical trade.

Fundamental investing (trading) is at its root, buying value. It is understanding where the weaknesses are and waiting for a market break where everything sells off, and buying the value. Very rarely is it buying at peak market values. You need to be very lucky to succeed in that scenario.

jog on

duc

@ducati916, thank you for your thoughtful response. I appreciate the time you took to address my points. Let me clarify some of my views.

1. Efficient Market Theory

I acknowledge that the "Efficient Market Theory" has its critics and isn't universally accepted but I don't accept that it has been thoroughly disproven. My point was not to fully endorse it, but rather to suggest that a significant amount of known information about a company is already priced into the market.

2. Market Efficiency

I apologise if my statements seemed contradictory. What I meant to convey is that while markets are mostly efficient, there are instances where they may not be, such as in the case of incomplete and outdated information or market manipulation.

3. Financial Statements

I agree with you that financial statements may not always reflect a company's true financial health. However, I believe that these discrepancies are often difficult to identify, even for skilled analysts.

4. System Trading

My belief in system trading stems from the idea that it can leverage data and patterns that may not be immediately apparent or accessible through traditional fundamental analysis. I understand that not all systems have high win rates, but I believe that with proper risk management, they can still be profitable.

5. Fundamental vs. Technical Investing (the can of worms)

I see value in both approaches and believe that they can complement each other. Fundamental analysis provides a deep understanding of a company's value, while technical analysis can help identify optimal entry and exit points.

6. Value Investing

I agree with your definition of value investing. It's about finding undervalued companies and waiting for the market to recognise their true value. However, I believe that this approach requires a high level of skill and patience, and may not be suitable for all investors. I posted about this very topic yesterday in the "Dump it here" thread.

I hope this clarifies my views.

Skate.