- Joined

- 13 February 2006

- Posts

- 5,056

- Reactions

- 11,454

a different explanation might be

land is an asset , it is tangible and clearly defined , gold is both an asset and a currency because it can be transported to a different owner relatively easily , gold can be used as a popular medium of settlement across jurisdictions

now a currency is only a medium of exchange ( both parties trust ) cash , diamonds , pearls , gold , some cryptos

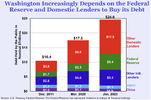

now some believed US treasuries were a reserve asset thinking the US would never scorch somebody who lent them billions,trillions of dollars worth of goods , that thinking is starting to change

my father used to tell me , 'if you have to buy your friends , you probably don't have any ( friends )

Mr divs,

It really comes down to: gold is no-one's liability.

jog on

duc