- Joined

- 30 June 2008

- Posts

- 15,424

- Reactions

- 7,296

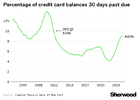

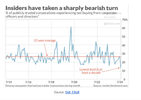

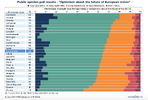

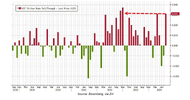

None of this looks good does it ? Post 12 from Ducati was stark.

We all "know" how leveraged and over blown our financial systems are. But we have studiously ignored it while the party was humming and the drinks flowing.

Now ?

We all "know" how leveraged and over blown our financial systems are. But we have studiously ignored it while the party was humming and the drinks flowing.

Now ?