Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,434

- Reactions

- 11,984

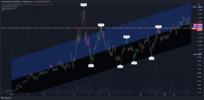

Thanks @rederob, silly me sold the WDS that I got from BHP to clear the decks and just an hour later some hotshots in a London trading house must have woken up, had a few snorts of coke, and read their emails from yesterday from some Arabs or Boris-Russians in the Lords or hidden from sanctions in Londongrad to buy WDS.Posted only to show the continuing uptrend, and that the average price of WTI in the past month is firmly over $110/bbl:

View attachment 142668

This looks like translating into another good day tomorrow for the likes of WDS, STO and BPT. In fact STO is just a shade of its 2020 pre-pandemic peak of $9.07.

I believe I missed the bus there, maybe not, lotsa different opinions on oilprice.com as to what ole MBS and Putin are up to with supply and pricing.

The Europeans are as all over the place now with Oil and Gas as they were with the Euro and the Pensions of Italians and Greeks who were quite rightly retiring at 42 and living off the rest of them.

Oil moves during all wars no matter what sanctions are put in place, like cigarettes, I've seen it.

gg