- Joined

- 8 March 2007

- Posts

- 2,853

- Reactions

- 3,942

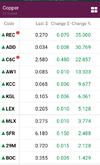

Ahoy there Captain SeanCopper seems to have bounced off that 4 bucks ish region. Interesting. For now. Just need another high and higher low. I have zero confidence in these charts right now.

View attachment 153392

What are doing up at 4.30 am?

Did you wet your bed?

LOL!