- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Looks like the banks are gonna have to hide another $100Billion or so off their books somewhere?

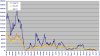

HONG KONG (MarketWatch) ”” The warning signs being flashed by the collapsing Baltic Dry Index (BDI), a leading global economic indicator, may reflect the folly of misguided expectations during the prior global economic boom, according to Hong Kong-based shipping analysts.

---

Macquarie analyst said Thursday the slump in the broader dry-bulk index represents “too much capacity in the face of more modest growth of trade volumes.”

---

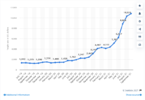

However, there could be knock-on effects if the supply glut results in a financial storm throughout the shipping industry.

Business Insider quoted Basil Karatzas, the chief executive of Karatzas Marine Advisors, as saying European banks could face nearly $100 billion in losses to restructure the $500 billion in shipping loans on their books.

Contagion....

HONG KONG (MarketWatch) ”” The warning signs being flashed by the collapsing Baltic Dry Index (BDI), a leading global economic indicator, may reflect the folly of misguided expectations during the prior global economic boom, according to Hong Kong-based shipping analysts.

---

Macquarie analyst said Thursday the slump in the broader dry-bulk index represents “too much capacity in the face of more modest growth of trade volumes.”

---

However, there could be knock-on effects if the supply glut results in a financial storm throughout the shipping industry.

Business Insider quoted Basil Karatzas, the chief executive of Karatzas Marine Advisors, as saying European banks could face nearly $100 billion in losses to restructure the $500 billion in shipping loans on their books.

Contagion....