- Joined

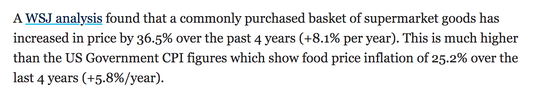

- 13 February 2006

- Posts

- 4,994

- Reactions

- 11,212

Oil News:

Friday, March 29th 2024

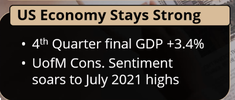

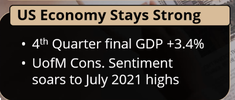

The oil markets are increasingly putting their trust into OPEC+ production cuts to remain in place throughout this year, a feat which combined with an improving macroeconomic outlook could bring $90 per barrel sooner than assumed. A better-than-expected Q4 for US GDP will most probably consolidate market expectations around a June interest rate cut, leaving behind the demand woes of early 2024. ICE Brent is set to close the week around the $87 per barrel mark, whilst WTI is trading around $83 per barrel.

Baltimore Closure Weighs Heavily on US Coal. The indefinite closure of the Port of Baltimore after the Francis Scott Key bridge collapsed this week will impact US thermal coal exports as Baltimore accounted for 28% of all seaborne outflows, affecting key shippers Arch Resources, Consol and Javelin.

US SPR Replenishment Cost Increasingly More. The latest round of strategic petroleum stock replenishments in the US, totalling 2.8 million barrels in September, has seen the average price hit $81.32 per barrel, above the $79 per barrel threshold that the White House mandated for refilling crude SPRs.

Iraq Extends Iran Gas Supply Deal for 5 Years. Iran agreed on an extension of a gas supply deal with Iraq for another five years, with Tehran sending up to 50 million cubic meters per day, accounting for approximately one-third of Iraq’s electricity generation in the peak-demand summer months.

Libya Oil Minister Fired Amidst Corruption Probe. Libya’s oil minister Mohamed Aoun was replaced within hours of his suspension with a replacement named from within the board of the state oil firm NOC, with Libya’s Tripoli government seeking to greenlight several multi-billion projects that he blocked.

Chile Urges SQM-Tianqi to Settle Scores. After China’s lithium giant Tianqi Lithium (SHE:002466), holding 20% in Chile’s SQM (NYSE:SQM), raised concerns over transparency in the Chilean company’s relationship with copper producer Codelco, the spat escalated to a governmental level with Chile’s Energy Ministry calling for a peaceful resolution.

UK’s Best Oil Eyes Eni Link-Up. UK offshore oil producer Ithaca Energy (LON:ITH), the majority owner of the controversial Cambo heavy oil project, is reportedly in talks with Italian major ENI (BIT:ENI) in a deal that would see Ithaca gain 40-45,000 b/d of producing assets whilst ENI would get a 38-39% stake in Ithaca.

US Treasury Targets Iran Oil Trade. In its sixth round of targeted Iran sanctions, the US Department of Treasury sanctioned Sa’id al-Jamal, a Houthi-linked network of companies that allegedly moves Iranian commodities through forged documents, as well as the Panama-flagged tanker Dawn II.

Nigeria Prompts Oil Producers to Keep Their Crude at Home. Representatives of Nigeria’s oil regulator NUPRC have met with the African country’s crude producers as their commitments to supply Nigerian crude to domestic refineries have been disappointing, with oil firms bemoaning the lack of payment guarantees.

Brazil Sees Buildup of Russian Diesel Tankers. Bloomberg reports that over 3.7 million barrels of Russian diesel has been idling in waters near the Brazilian coast, underscoring the growing bottlenecks in Russian energy deliveries as at least two tankers belong to sanctioned shipper Sovcomflot.

Mexico’s Crude Output Falls to Lowest Since 1979. Crude production of Mexico’s state oil company Pemex fell to its lowest monthly level in 45 years this February, pumping 1.55 million b/d of oil, with the world’s most indebted firm coming well below the government-set output target of 1.9 million b/d.

Kenya and Uganda Settle Their Import Spat. Kenya will allow landlocked Uganda to import oil products through its port of Mombasa, ending a longstanding dispute between the two neighbours, as Uganda’s government handed over exclusive oil product supply rights to global trading firm Vitol.

New Senegal President Questions Oil Deals. Senegal’s newly elected President Bassirou Faye intends to revisit the contractual terms offered to oil companies BP (NYSE:BP), Kosmos Energy (NYSE:KOS) and Woodside Energy (ASX:WDS), making good on his pre-election pledge to increase the state’s ownership of the Grand Tortue and Sangomar projects.

Vietnam Draws Closer to Qatari LNG. Vietnam will be ramping up LNG imports after the July 2023 commissioning of its Thi Vai LNG import terminal, signing its first ever LNG supply deal with Qatar for an April-delivery cargo as the South Asian country’s power demand is expected to grow 10-12% per year.

Staying on the topic of oil:

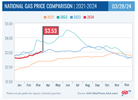

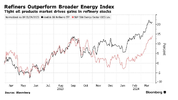

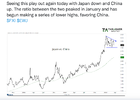

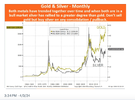

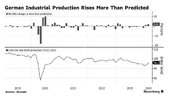

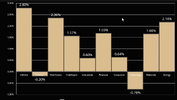

These 3 charts show the inverted currency as against oil:

On the gold thread I opined that when the BoJ raised rates and the Yen FELL as opposed to RISING, the reason was that Japan was now buying oil in Yen. As are India and China. This is bullish for gold. Gold has broken out of a high base that was 3/4yrs in the making. As gold increasingly becomes THE oil currency, gold will continue to move higher.

With a higher market share in energy (more oil purchased) these economies will grow (much) faster than the US economy, already at the point of collapse.

Assuming that demand for USD continues to grow, but that the size of the US economy continues to fall relative to the rest of the world:

(a) there will be a run on the USD;

(b) which will morph into one or more alternatives: gold, Euro, Yuan;

(c) is what happened in 1931 when the pound sterling was abandoned and from USD in 1933 (USD then devalued as against gold)

(d) the result being that the US would default on foreign liabilities.

International financial markets (all tightly interlinked) would enter a major crisis.

There seem to be a number of issues that Wall St. have a consensus on:

(i) a weaker Yuan. Incorrect. The Yuan will (need) to grow stronger as against USD. China is after joining the WTO, hollowed out US manufacturing to such a point that the US is almost helpless. It is unbelievable that US politicians were so stupid/greedy/venal/dishonest/corrupt to the point where the US now finds itself.

(ii) that falling FFR will result in an even higher rally in US equities. So acute is the US/China issue re. trade imbalances, that unemployment, currently believed to be a solid data point, will ramp up and explode higher.

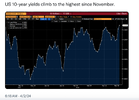

(iii): Bonds will rally (falling yields)

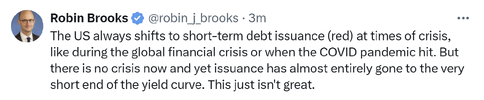

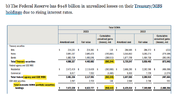

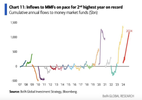

The long end of the curve is not fixed. The long end of the curve is fuc*ed and looking to become far worse. The Treasury is issuing Bills (short end of the curve) because currently the MM funds can and will buy as they shift out of RRP into short dated UST paper. That RRP is almost empty. When it is empty, Yellen could run down (again) the TGA ($800B) which could see the US into the Presidential elections, assuming nothing else blows up in the interim.

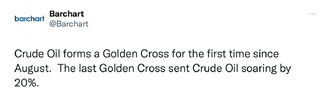

(iv): Oil will stay in range or fall

Looking to go higher.

A higher oil price in USD bought by the US when all others are buying in their own currencies and settling in gold creates a high gold price to Yuan/Rupees/Yen but a low gold price (relative) to USD. The US becomes a victim in that gold/USD buys them less oil priced in gold. Everyone else gets more oil for their gold/Yuan/Yen/Rupee.

Also posted in the gold thread, the diminishing productivity of shale over time. Not an issue today, but going forward when the rest of the world's oil production is increasingly demanded and bought by China and India, both with huge populations. Africa waiting in the wings.

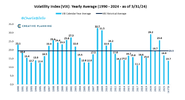

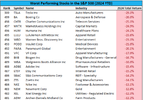

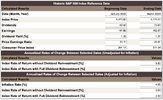

So last week and next week:

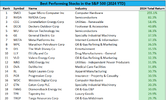

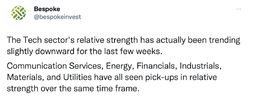

Check out last weeks rankings and you'll see that the ranked sectors did well.

Economic news for next week:

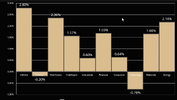

Next week's rankings:

Of these: XLB, XLI, XLE are the most bullish charts. The rest are +3 but their charts are not as strong. Possibly XLU having just broken out higher could join the first 3.

jog on

duc

Friday, March 29th 2024

The oil markets are increasingly putting their trust into OPEC+ production cuts to remain in place throughout this year, a feat which combined with an improving macroeconomic outlook could bring $90 per barrel sooner than assumed. A better-than-expected Q4 for US GDP will most probably consolidate market expectations around a June interest rate cut, leaving behind the demand woes of early 2024. ICE Brent is set to close the week around the $87 per barrel mark, whilst WTI is trading around $83 per barrel.

Baltimore Closure Weighs Heavily on US Coal. The indefinite closure of the Port of Baltimore after the Francis Scott Key bridge collapsed this week will impact US thermal coal exports as Baltimore accounted for 28% of all seaborne outflows, affecting key shippers Arch Resources, Consol and Javelin.

US SPR Replenishment Cost Increasingly More. The latest round of strategic petroleum stock replenishments in the US, totalling 2.8 million barrels in September, has seen the average price hit $81.32 per barrel, above the $79 per barrel threshold that the White House mandated for refilling crude SPRs.

Iraq Extends Iran Gas Supply Deal for 5 Years. Iran agreed on an extension of a gas supply deal with Iraq for another five years, with Tehran sending up to 50 million cubic meters per day, accounting for approximately one-third of Iraq’s electricity generation in the peak-demand summer months.

Libya Oil Minister Fired Amidst Corruption Probe. Libya’s oil minister Mohamed Aoun was replaced within hours of his suspension with a replacement named from within the board of the state oil firm NOC, with Libya’s Tripoli government seeking to greenlight several multi-billion projects that he blocked.

Chile Urges SQM-Tianqi to Settle Scores. After China’s lithium giant Tianqi Lithium (SHE:002466), holding 20% in Chile’s SQM (NYSE:SQM), raised concerns over transparency in the Chilean company’s relationship with copper producer Codelco, the spat escalated to a governmental level with Chile’s Energy Ministry calling for a peaceful resolution.

UK’s Best Oil Eyes Eni Link-Up. UK offshore oil producer Ithaca Energy (LON:ITH), the majority owner of the controversial Cambo heavy oil project, is reportedly in talks with Italian major ENI (BIT:ENI) in a deal that would see Ithaca gain 40-45,000 b/d of producing assets whilst ENI would get a 38-39% stake in Ithaca.

US Treasury Targets Iran Oil Trade. In its sixth round of targeted Iran sanctions, the US Department of Treasury sanctioned Sa’id al-Jamal, a Houthi-linked network of companies that allegedly moves Iranian commodities through forged documents, as well as the Panama-flagged tanker Dawn II.

Nigeria Prompts Oil Producers to Keep Their Crude at Home. Representatives of Nigeria’s oil regulator NUPRC have met with the African country’s crude producers as their commitments to supply Nigerian crude to domestic refineries have been disappointing, with oil firms bemoaning the lack of payment guarantees.

Brazil Sees Buildup of Russian Diesel Tankers. Bloomberg reports that over 3.7 million barrels of Russian diesel has been idling in waters near the Brazilian coast, underscoring the growing bottlenecks in Russian energy deliveries as at least two tankers belong to sanctioned shipper Sovcomflot.

Mexico’s Crude Output Falls to Lowest Since 1979. Crude production of Mexico’s state oil company Pemex fell to its lowest monthly level in 45 years this February, pumping 1.55 million b/d of oil, with the world’s most indebted firm coming well below the government-set output target of 1.9 million b/d.

Kenya and Uganda Settle Their Import Spat. Kenya will allow landlocked Uganda to import oil products through its port of Mombasa, ending a longstanding dispute between the two neighbours, as Uganda’s government handed over exclusive oil product supply rights to global trading firm Vitol.

New Senegal President Questions Oil Deals. Senegal’s newly elected President Bassirou Faye intends to revisit the contractual terms offered to oil companies BP (NYSE:BP), Kosmos Energy (NYSE:KOS) and Woodside Energy (ASX:WDS), making good on his pre-election pledge to increase the state’s ownership of the Grand Tortue and Sangomar projects.

Vietnam Draws Closer to Qatari LNG. Vietnam will be ramping up LNG imports after the July 2023 commissioning of its Thi Vai LNG import terminal, signing its first ever LNG supply deal with Qatar for an April-delivery cargo as the South Asian country’s power demand is expected to grow 10-12% per year.

Staying on the topic of oil:

These 3 charts show the inverted currency as against oil:

On the gold thread I opined that when the BoJ raised rates and the Yen FELL as opposed to RISING, the reason was that Japan was now buying oil in Yen. As are India and China. This is bullish for gold. Gold has broken out of a high base that was 3/4yrs in the making. As gold increasingly becomes THE oil currency, gold will continue to move higher.

With a higher market share in energy (more oil purchased) these economies will grow (much) faster than the US economy, already at the point of collapse.

Assuming that demand for USD continues to grow, but that the size of the US economy continues to fall relative to the rest of the world:

(a) there will be a run on the USD;

(b) which will morph into one or more alternatives: gold, Euro, Yuan;

(c) is what happened in 1931 when the pound sterling was abandoned and from USD in 1933 (USD then devalued as against gold)

(d) the result being that the US would default on foreign liabilities.

International financial markets (all tightly interlinked) would enter a major crisis.

There seem to be a number of issues that Wall St. have a consensus on:

(i) a weaker Yuan. Incorrect. The Yuan will (need) to grow stronger as against USD. China is after joining the WTO, hollowed out US manufacturing to such a point that the US is almost helpless. It is unbelievable that US politicians were so stupid/greedy/venal/dishonest/corrupt to the point where the US now finds itself.

(ii) that falling FFR will result in an even higher rally in US equities. So acute is the US/China issue re. trade imbalances, that unemployment, currently believed to be a solid data point, will ramp up and explode higher.

(iii): Bonds will rally (falling yields)

The long end of the curve is not fixed. The long end of the curve is fuc*ed and looking to become far worse. The Treasury is issuing Bills (short end of the curve) because currently the MM funds can and will buy as they shift out of RRP into short dated UST paper. That RRP is almost empty. When it is empty, Yellen could run down (again) the TGA ($800B) which could see the US into the Presidential elections, assuming nothing else blows up in the interim.

(iv): Oil will stay in range or fall

Looking to go higher.

A higher oil price in USD bought by the US when all others are buying in their own currencies and settling in gold creates a high gold price to Yuan/Rupees/Yen but a low gold price (relative) to USD. The US becomes a victim in that gold/USD buys them less oil priced in gold. Everyone else gets more oil for their gold/Yuan/Yen/Rupee.

Also posted in the gold thread, the diminishing productivity of shale over time. Not an issue today, but going forward when the rest of the world's oil production is increasingly demanded and bought by China and India, both with huge populations. Africa waiting in the wings.

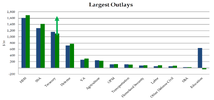

So last week and next week:

Check out last weeks rankings and you'll see that the ranked sectors did well.

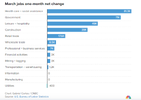

Economic news for next week:

Next week's rankings:

Of these: XLB, XLI, XLE are the most bullish charts. The rest are +3 but their charts are not as strong. Possibly XLU having just broken out higher could join the first 3.

jog on

duc