- Joined

- 13 February 2006

- Posts

- 5,083

- Reactions

- 11,540

Oil News:

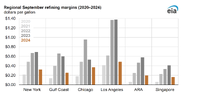

The September monthly average refining margin fell to its lowest for the month since 2020, indicating that the downstream supercycle that was boosted by COVID-related disruptions and Russia sanctions is now ending.

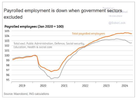

- Disappointing diesel demand remains a headache for refiners as US product supply of distillate fuel oil dipped 6% year-over-year in 2024 to date amidst declining manufacturing activity and higher biofuel consumption.

- The International Energy Agency has revised its global refinery runs forecast for this year to 82.8 million b/d, down by 180,000 b/d from its previous estimate, also expecting a mere 0.6 million b/d year-over-year increase in 2025.

- Weaker seasonal maintenance works have also added downward pressure to refining margins, prompting coastal refiners to cut runs; Asian import-dependent refiners in Taiwan and South Korea started the trend, and now Spanish and Italian refiners are slashing throughput, too.

Market Movers

- US oil major ExxonMobil (NYSE:XOM) is moving on with the second stage of exploration in a block it operates offshore the Greek island of Crete, after an extensive seismic survey found several prospective plays.

- US refiner Phillips 66 (NYSE SX) has completed its divestment of retail stations across Central Europe, selling its 49% stake in its Swiss joint venture with Coop for $1.24 billion in an all-cash deal.

SX) has completed its divestment of retail stations across Central Europe, selling its 49% stake in its Swiss joint venture with Coop for $1.24 billion in an all-cash deal.

- Brazil’s state oil company Petrobras (NYSE BR) is planning to cut its capital expenditures for 2025, down to $17 billion from the previously assumed $21 billion, despite government requests to invest more.

BR) is planning to cut its capital expenditures for 2025, down to $17 billion from the previously assumed $21 billion, despite government requests to invest more.

Tuesday, October 15, 2024

Following ten heated days of geopolitical speculation, the risk of seeing the Israel-Iran standoff degenerate into an oil price rally is evaporating, as Prime Minister Netanyahu vowed to strike military targets and not oil ones. This has brought macroeconomics back into the limelight with OPEC cutting its 2025 forecast again and China continuing to report weak import numbers. All of that saw ICE Brent slump back to $74 per barrel and WTI fall to within touching distance of the $70 mark.

US Tightens Sanctions on Iranian Exports. The US Treasury and State Departments slapped sanctions on 23 tankers and 16 entities involved in the ghost fleet enabling Iranian crude oil flows to China, expected to lower the 1.6 million b/d of oil flowing to China’s teapot refiners in Shandong.

OPEC Cuts Crude Demand Forecasts Again. For the third consecutive month, OPEC slashed its forecast for global crude oil demand growth in both 2024 and 2025 to reflect weaker Chinese consumption, however even now its annual increment is above consensus at 1.93 million b/d.

Chinese Oil Major Quits TMX Term Deal. China’s national oil company PetroChina (SHA:601857) will no longer be a committed shipper on the 590,000 b/d Trans Mountain Expansion pipeline after it had assigned its contract to another party, without naming the recipient of its term capacity.

Pemex’s US Refinery Leaks Toxic Substance. The 313,000 b/d Deer Park refinery operated by Mexico’s state oil firm Pemex discharged some 43,500 pounds of highly toxic hydrogen sulfide gas into the atmosphere, several hours after a deadly incident that killed two contract workers.

Iraq Claims OPEC+ Quota Compliance. According to Iraqi officials, the country produced 3.94 million b/d of oil in September, less than its 4 million b/d OPEC+ output target for the first time this year, although it seems to be based on the debatable claim that Kurdistan halved its production to 140,000 b/d.

Japan Mulls Expanding LNG Reserve Stocks. Japan is considering ramping up purchases of LNG for emergency needs to at least 12 cargoes per year from its current pace of 3 cargoes annually, equivalent to more than 0.6 million tonnes of LNG of additional demand to safeguard against price shocks.

Norwegian Courts Side with Oil & Gas Projects. A Norwegian appeals court had ruled in favor of the government against environmental activist groups that sought to halt three upcoming oil projects – Yggdrasil, Tyrving, and Breidablikk – boosting the production outlook of Equinor and Aker BP.

The Fight for The Largest Zinc Smelter Begins. Tension is piling up around the world’s largest zinc smelter Korea Zinc after buyout investment firm MBK Partners bought a 5.34% stake in the company amidst a multi-billion-dollar succession feud, eyeing a future takeover of operations.

Chinese EV Sales Hit All-Time High. China’s new energy vehicle sales reached 1.29 million units last month, up 17% month-over-month and 42% year-over-year, with the new record high indicating Beijing’s stimulus measures might stimulate non-fossil cars more than conventional ones.

US Major to Recover Billions of Venezuela Arrears. US upstream firm ConocoPhillips (NYSE:COP) has received a US government license to recoup the almost $10 billion owed by Venezuela, enabling it to pursue legal action against PDVSA in countries where the latter holds financial assets.

Congo Cancels Upstream Licensing Round. The Democratic Republic of Congo canceled a licensing round for 27 oil blocks it launched two years ago, citing weak competition and inappropriate offers, easing fears that oil drilling could expand into Africa’s second-largest rainforest.

Malaysia Doubles Down on South China Sea Exploration. Malaysia’s Prime Minister Anwar Ibrahim confirmed that the country’s state oil company Petronas would continue oil and gas exploration activities in the South China Sea, defying recent dissatisfactory remarks from China.

China Reports Wind Technology Breakthrough. Chinese power generation manufacturer Dongfang Electric (SHA:600875) rolled out a wind turbine with a capacity of 26 MW, surpassing any existing or announced model and beating the previous record capacity of 18 MW by a wide margin.

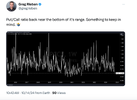

Today's Chart of the Day was shared by Larry Thompson (@HostileCharts).

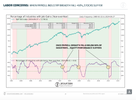

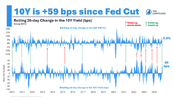

New one to me XLG.

Generally speaking, we've seen dividend stocks outperform when longer-term Treasury yields are falling and underperform when Treasury yields are rising. As you can see in the chart, dividend stocks outperformed quite dramatically from early April through September ahead of the Fed's recent 50 basis point rate cut, but they've taken a pause in the last few weeks as the yield on the 10-year Treasury has actually risen in response to the cut in the fed funds rate. If you think Treasury yields will continue higher from here, dividend stocks will likely remain weak relative to the rest of the market. If you're of the opposite view and think Treasury yields will pull back, dividend stocks will have that as a tailwind.

I covered my shorts and upped cash to nearly 70%, watching from the tall grass. My longs consist of non tech stocks, financials and REITs, mostly immune to the volatility present in the tape. But if we get a rout, nothing will be immune.

A few thoughts

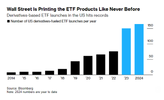

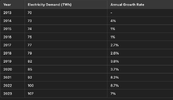

Amazon inked an energy deal for nuclear today and we are seeing these deals almost non stop. As a result, nuclear plays like $CCJ and $SMR are taking off. This is a long term bullish trend of note.

Anything related to energy and the efficiency by which the energy is handled and maintained is a good play. This spills over into data centers and who cools them, namely $ETN and $VRT.

On the Orwellian front, I’ve been looking into $YOU recently and learned they’re expanding past the TSA pre clear checkins to facial recognition in retail stores to fight shrinkage, casinos to fight cheats, and have targeted financial services to combat fraud. In other words, identity via your face is being used to reduce friction and combat crime. This is the brave new world and it’s extremely profitable .

Last thing I’ll touch on is $HOOD. Many only view this as a low brow brokerage play, but it’s much more than that. They have more millennial and gen z clients than all other online brokers combined. What this means for when the boomers pass on and pass down their wealth is a tailwind. They’re also getting competitive in the credit card biz, margin lending and subscription services via their gold package. Naturally this all works in a strong market environment, which I think for the most part is a safe bet.

jog on

duc

The September monthly average refining margin fell to its lowest for the month since 2020, indicating that the downstream supercycle that was boosted by COVID-related disruptions and Russia sanctions is now ending.

- Disappointing diesel demand remains a headache for refiners as US product supply of distillate fuel oil dipped 6% year-over-year in 2024 to date amidst declining manufacturing activity and higher biofuel consumption.

- The International Energy Agency has revised its global refinery runs forecast for this year to 82.8 million b/d, down by 180,000 b/d from its previous estimate, also expecting a mere 0.6 million b/d year-over-year increase in 2025.

- Weaker seasonal maintenance works have also added downward pressure to refining margins, prompting coastal refiners to cut runs; Asian import-dependent refiners in Taiwan and South Korea started the trend, and now Spanish and Italian refiners are slashing throughput, too.

Market Movers

- US oil major ExxonMobil (NYSE:XOM) is moving on with the second stage of exploration in a block it operates offshore the Greek island of Crete, after an extensive seismic survey found several prospective plays.

- US refiner Phillips 66 (NYSE

- Brazil’s state oil company Petrobras (NYSE

Tuesday, October 15, 2024

Following ten heated days of geopolitical speculation, the risk of seeing the Israel-Iran standoff degenerate into an oil price rally is evaporating, as Prime Minister Netanyahu vowed to strike military targets and not oil ones. This has brought macroeconomics back into the limelight with OPEC cutting its 2025 forecast again and China continuing to report weak import numbers. All of that saw ICE Brent slump back to $74 per barrel and WTI fall to within touching distance of the $70 mark.

US Tightens Sanctions on Iranian Exports. The US Treasury and State Departments slapped sanctions on 23 tankers and 16 entities involved in the ghost fleet enabling Iranian crude oil flows to China, expected to lower the 1.6 million b/d of oil flowing to China’s teapot refiners in Shandong.

OPEC Cuts Crude Demand Forecasts Again. For the third consecutive month, OPEC slashed its forecast for global crude oil demand growth in both 2024 and 2025 to reflect weaker Chinese consumption, however even now its annual increment is above consensus at 1.93 million b/d.

Chinese Oil Major Quits TMX Term Deal. China’s national oil company PetroChina (SHA:601857) will no longer be a committed shipper on the 590,000 b/d Trans Mountain Expansion pipeline after it had assigned its contract to another party, without naming the recipient of its term capacity.

Pemex’s US Refinery Leaks Toxic Substance. The 313,000 b/d Deer Park refinery operated by Mexico’s state oil firm Pemex discharged some 43,500 pounds of highly toxic hydrogen sulfide gas into the atmosphere, several hours after a deadly incident that killed two contract workers.

Iraq Claims OPEC+ Quota Compliance. According to Iraqi officials, the country produced 3.94 million b/d of oil in September, less than its 4 million b/d OPEC+ output target for the first time this year, although it seems to be based on the debatable claim that Kurdistan halved its production to 140,000 b/d.

Japan Mulls Expanding LNG Reserve Stocks. Japan is considering ramping up purchases of LNG for emergency needs to at least 12 cargoes per year from its current pace of 3 cargoes annually, equivalent to more than 0.6 million tonnes of LNG of additional demand to safeguard against price shocks.

Norwegian Courts Side with Oil & Gas Projects. A Norwegian appeals court had ruled in favor of the government against environmental activist groups that sought to halt three upcoming oil projects – Yggdrasil, Tyrving, and Breidablikk – boosting the production outlook of Equinor and Aker BP.

The Fight for The Largest Zinc Smelter Begins. Tension is piling up around the world’s largest zinc smelter Korea Zinc after buyout investment firm MBK Partners bought a 5.34% stake in the company amidst a multi-billion-dollar succession feud, eyeing a future takeover of operations.

Chinese EV Sales Hit All-Time High. China’s new energy vehicle sales reached 1.29 million units last month, up 17% month-over-month and 42% year-over-year, with the new record high indicating Beijing’s stimulus measures might stimulate non-fossil cars more than conventional ones.

US Major to Recover Billions of Venezuela Arrears. US upstream firm ConocoPhillips (NYSE:COP) has received a US government license to recoup the almost $10 billion owed by Venezuela, enabling it to pursue legal action against PDVSA in countries where the latter holds financial assets.

Congo Cancels Upstream Licensing Round. The Democratic Republic of Congo canceled a licensing round for 27 oil blocks it launched two years ago, citing weak competition and inappropriate offers, easing fears that oil drilling could expand into Africa’s second-largest rainforest.

Malaysia Doubles Down on South China Sea Exploration. Malaysia’s Prime Minister Anwar Ibrahim confirmed that the country’s state oil company Petronas would continue oil and gas exploration activities in the South China Sea, defying recent dissatisfactory remarks from China.

China Reports Wind Technology Breakthrough. Chinese power generation manufacturer Dongfang Electric (SHA:600875) rolled out a wind turbine with a capacity of 26 MW, surpassing any existing or announced model and beating the previous record capacity of 18 MW by a wide margin.

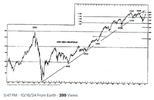

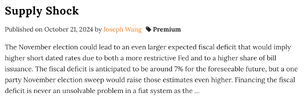

Today's Chart of the Day was shared by Larry Thompson (@HostileCharts).

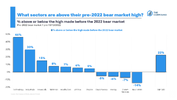

- Larry points out that the S&P 500 Top 50 ETF ($XLG) closed at all-time highs after gapping above resistance from the July peak, around $48.

- When price gaps above a well-defined resistance level like this, it's called a Breakaway Gap, the most bullish type of breakout.

- $XLG is resolving higher out of a three-month Ascending Triangle pattern. This bullish pattern is defined by horizontal resistance at $48 and rising trendline support.

New one to me XLG.

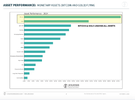

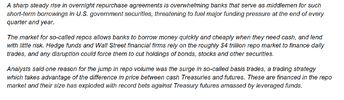

Generally speaking, we've seen dividend stocks outperform when longer-term Treasury yields are falling and underperform when Treasury yields are rising. As you can see in the chart, dividend stocks outperformed quite dramatically from early April through September ahead of the Fed's recent 50 basis point rate cut, but they've taken a pause in the last few weeks as the yield on the 10-year Treasury has actually risen in response to the cut in the fed funds rate. If you think Treasury yields will continue higher from here, dividend stocks will likely remain weak relative to the rest of the market. If you're of the opposite view and think Treasury yields will pull back, dividend stocks will have that as a tailwind.

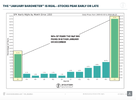

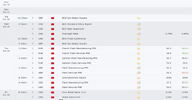

- Small Caps have lagged all year, but the Russell 2000 ($IWM) has set the stage for a year-end rally. It closed slightly positive today, while the other three major indices fell.

- Over the past three months, the index has coiled into a narrow range as pressure builds for an explosive move in either direction. Yesterday, Chris pointed out that Friday was a 90% up day for the Russell 2000.

- Regional Banks ($KRE) are the largest industry group within the Russell 2000, representing 10% of the index. Chris adds that $KRE and $IWM look ready to run if they can clear $60 and $225, respectively.

Random Market Thoughts

Wed Oct 16, 2024 10:00am EST 1I covered my shorts and upped cash to nearly 70%, watching from the tall grass. My longs consist of non tech stocks, financials and REITs, mostly immune to the volatility present in the tape. But if we get a rout, nothing will be immune.

A few thoughts

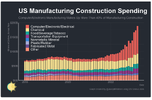

Amazon inked an energy deal for nuclear today and we are seeing these deals almost non stop. As a result, nuclear plays like $CCJ and $SMR are taking off. This is a long term bullish trend of note.

Anything related to energy and the efficiency by which the energy is handled and maintained is a good play. This spills over into data centers and who cools them, namely $ETN and $VRT.

On the Orwellian front, I’ve been looking into $YOU recently and learned they’re expanding past the TSA pre clear checkins to facial recognition in retail stores to fight shrinkage, casinos to fight cheats, and have targeted financial services to combat fraud. In other words, identity via your face is being used to reduce friction and combat crime. This is the brave new world and it’s extremely profitable .

Last thing I’ll touch on is $HOOD. Many only view this as a low brow brokerage play, but it’s much more than that. They have more millennial and gen z clients than all other online brokers combined. What this means for when the boomers pass on and pass down their wealth is a tailwind. They’re also getting competitive in the credit card biz, margin lending and subscription services via their gold package. Naturally this all works in a strong market environment, which I think for the most part is a safe bet.

jog on

duc