- Joined

- 29 January 2006

- Posts

- 7,231

- Reactions

- 4,491

When I posted back in 2007 we had some hybrid EVs to use as a base for calculating the impact that EVs would have on the copper market.

Wood Mackenzie use this figure for their assessment:

The substitution effect is about 50 extra kilos/EV or 20 EVs to the tonne.

Translating this to EV uptake we can say that for every 20K EV's on the road we need an extra 1K of copper.

demand.

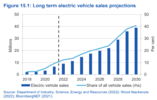

Various studies put EV annual compounding growth rates into the 2020's above 30%. Using the chart data below as a base, let's say in 2021 we get one million additional EVs registered.

So that's an extra 50K tonnes more than 2020 just for cars. Then there's buses, heavy vehicles and associated charging infrastructure.

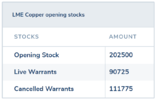

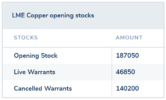

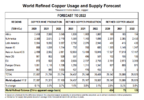

Here's the ISCG's copper forecasts for this year and next:

I don't know what the ISCG has used for it's EV data inputs, but if they prove conservative then this market segment alone can move 2021 and 2022 back into deficit.

Wood Mackenzie use this figure for their assessment:

The substitution effect is about 50 extra kilos/EV or 20 EVs to the tonne.

Translating this to EV uptake we can say that for every 20K EV's on the road we need an extra 1K of copper.

demand.

Various studies put EV annual compounding growth rates into the 2020's above 30%. Using the chart data below as a base, let's say in 2021 we get one million additional EVs registered.

So that's an extra 50K tonnes more than 2020 just for cars. Then there's buses, heavy vehicles and associated charging infrastructure.

Here's the ISCG's copper forecasts for this year and next:

I don't know what the ISCG has used for it's EV data inputs, but if they prove conservative then this market segment alone can move 2021 and 2022 back into deficit.