Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,647

- Reactions

- 12,256

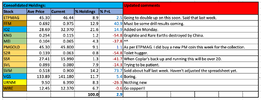

While there might be some more to be squeezed out of this, I should use my brain and take some profits. But, breaking ATHs makes me think just technically there's no ceiling. So, I'm vexed. I'll probably hold it and then it's crash.

View attachment 194085

I squeezed a little more and sold half of this at .915 for about a 70% gain. Will probably run to 2 bucks now.