You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ZFX - Zinifex Limited

- Thread starter chicken

- Start date

-

- Tags

- zfx zinifex limited

Just been looking at agm's web site progress photos of the plant at Avebury. I have worked on construction sites similar to this and if the dates on these photos are right there is no way production will start this quarter. Will be lucky to be going next quarter, must be what zfx is waiting for.

- Joined

- 30 December 2007

- Posts

- 591

- Reactions

- 0

You're spot on johnno. I rang the company yesterday and asked if they were starting production in the 1st QTR and the response was a lot of oooing and arring. "Our aim is to be in production by the end of the 1st qtr".

Note the word AIM.

They will be lucky to start commissioning by June and then production after that. It will be a year overdue from the Sep 2006 deadline is my tip.

Note the word AIM.

They will be lucky to start commissioning by June and then production after that. It will be a year overdue from the Sep 2006 deadline is my tip.

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

You're spot on johnno. I rang the company yesterday and asked if they were starting production in the 1st QTR and the response was a lot of oooing and arring. "Our aim is to be in production by the end of the 1st qtr".

Note the word AIM.

They will be lucky to start commissioning by June and then production after that. It will be a year overdue from the Sep 2006 deadline is my tip.

well, what a hoot! - it's interesting the response you got BB, I wonder how many AGM shareholders really know the state of affairs other than the spin dished out in news releases ...

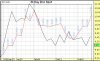

Unfortunately I don't see much of an uptrend yet for Zinc.. It's stopped it's downward trend and bottomed somewhat, which is a good sign..

However, while Zinc prices remain at these prices, and $AUD continues to hover around $US0.90, companies such as ZFX and CBH will continue to sit pretty flat.

However, while Zinc prices remain at these prices, and $AUD continues to hover around $US0.90, companies such as ZFX and CBH will continue to sit pretty flat.

Attachments

Johnno71

You said

Report in the afr this morning saying macquarie have off loaded their AGM shares to a hedge fund. Anybody got any idea want is going on with this company?

If you check the "AGM" notices at the ASX you will find a notice from Macquarie

"becoming a substantial holder" 20/2/07 they haven't unloaded

Happyjack

You said

Report in the afr this morning saying macquarie have off loaded their AGM shares to a hedge fund. Anybody got any idea want is going on with this company?

If you check the "AGM" notices at the ASX you will find a notice from Macquarie

"becoming a substantial holder" 20/2/07 they haven't unloaded

Happyjack

AFR yesterday

"In a much longer running take over battle, it's worth noting that 4.5% of Allegiance Mining that changed hands this week was snapped up by a hedge fund, via some sort of swap deal with Macquarie. The deal implies the pressure for a resolution is still building, although hostilities between the two camps have thawed slightly."

Might be rubbish report, but UBS annouced they had acquired 5.52% of AGM on the 14th of Feb. Macquarie picked up 35 million shares from someone late on the 19th. Lion Selection's shares are in dispute with takeovers Panel, so I don't think they can sell and the chinese wouldn't sell theirs, so it must have been UBS who sold. They haven't announced it to the ASX and maybe Macquarie don't have to announce that they have got rid of their AGM shares either.

"In a much longer running take over battle, it's worth noting that 4.5% of Allegiance Mining that changed hands this week was snapped up by a hedge fund, via some sort of swap deal with Macquarie. The deal implies the pressure for a resolution is still building, although hostilities between the two camps have thawed slightly."

Might be rubbish report, but UBS annouced they had acquired 5.52% of AGM on the 14th of Feb. Macquarie picked up 35 million shares from someone late on the 19th. Lion Selection's shares are in dispute with takeovers Panel, so I don't think they can sell and the chinese wouldn't sell theirs, so it must have been UBS who sold. They haven't announced it to the ASX and maybe Macquarie don't have to announce that they have got rid of their AGM shares either.

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

Zinc had a good night - up 5.2%

Bloomberg report via Kitco Metals:

Yunan Producers

Yunnan Luoping Zinc & Electricity Co., a copper producer based in China's Yunnan province, said today it cut output because of a lack of power. Yunnan Chihong Zinc and Germanium Co. said yesterday it had reduced output since Feb. 11.

Zinc and lead rose on speculation power shortages in China, the world's largest producer of both metals, will reduce supply after the country's worst snowstorms in decades halted smelters and mines, and cut transportation links from late January.

Yunnan Luoping Zinc & Electricity Co., a producer of the metal based in China's Yunnan province, said today it cut output because of a lack of power. Yunnan Chihong Zinc and Germanium Co. said yesterday it had reduced output since Feb. 11.

``Damage to production areas in China is more significant than some had thought,'' said Alex Heath, head of industrial metals trading at RBC Capital Markets in London. People are buying the metal in ``panic,'' he said.

Zinc Rally

Zinc rose as much as $145, or 6 percent, to $2,555, the highest intraday price since Feb. 1. Shanghai zinc for May delivery rose by the exchange-imposed daily limit of 4 percent. Special high-grade zinc for immediate delivery in Changjiang, Shanghai's biggest cash market, gained as much as 7.2 percent.

Stockpiles of the metal tracked by the LME rose to a four- month high of 121,050 tons. Still, its availability is limited as LME figures show one company controlled between 50 percent and 79 percent of total inventories as of Feb. 19.

At today's cash price and excluding zinc earmarked for withdrawal, it would cost about $277.2 million to hold half of the LME-monitored stockpiles of the metal.

Barclays Capital projected China's lost zinc output at about 45,000 tons, less than 1 percent of last year's total world production of 11.41 million tons estimated by the International Lead and Zinc Study Group. Stockpiles of the metal are adequate to fill any gap, the bank's analysts led by Kevin Norrish in London wrote today in a report.

Outpacing Supply

Zinc and lead consumption exceeded production last year, although the supply shortfall in both metals was lower than in 2006, according to Lisbon-based ILZSG.

China's zinc demand expanded 15 percent last year, accounting for a third of world use. The country's demand for lead rose 15 percent in 2007. China is the world's largest user of both metals, the Lisbon-based group said Feb. 18.

Lead climbed as much as $84.15, or 2.6 percent, to $3,360.15 a ton, the highest since Nov. 16.

Bloomberg report via Kitco Metals:

Yunan Producers

Yunnan Luoping Zinc & Electricity Co., a copper producer based in China's Yunnan province, said today it cut output because of a lack of power. Yunnan Chihong Zinc and Germanium Co. said yesterday it had reduced output since Feb. 11.

Zinc and lead rose on speculation power shortages in China, the world's largest producer of both metals, will reduce supply after the country's worst snowstorms in decades halted smelters and mines, and cut transportation links from late January.

Yunnan Luoping Zinc & Electricity Co., a producer of the metal based in China's Yunnan province, said today it cut output because of a lack of power. Yunnan Chihong Zinc and Germanium Co. said yesterday it had reduced output since Feb. 11.

``Damage to production areas in China is more significant than some had thought,'' said Alex Heath, head of industrial metals trading at RBC Capital Markets in London. People are buying the metal in ``panic,'' he said.

Zinc Rally

Zinc rose as much as $145, or 6 percent, to $2,555, the highest intraday price since Feb. 1. Shanghai zinc for May delivery rose by the exchange-imposed daily limit of 4 percent. Special high-grade zinc for immediate delivery in Changjiang, Shanghai's biggest cash market, gained as much as 7.2 percent.

Stockpiles of the metal tracked by the LME rose to a four- month high of 121,050 tons. Still, its availability is limited as LME figures show one company controlled between 50 percent and 79 percent of total inventories as of Feb. 19.

At today's cash price and excluding zinc earmarked for withdrawal, it would cost about $277.2 million to hold half of the LME-monitored stockpiles of the metal.

Barclays Capital projected China's lost zinc output at about 45,000 tons, less than 1 percent of last year's total world production of 11.41 million tons estimated by the International Lead and Zinc Study Group. Stockpiles of the metal are adequate to fill any gap, the bank's analysts led by Kevin Norrish in London wrote today in a report.

Outpacing Supply

Zinc and lead consumption exceeded production last year, although the supply shortfall in both metals was lower than in 2006, according to Lisbon-based ILZSG.

China's zinc demand expanded 15 percent last year, accounting for a third of world use. The country's demand for lead rose 15 percent in 2007. China is the world's largest user of both metals, the Lisbon-based group said Feb. 18.

Lead climbed as much as $84.15, or 2.6 percent, to $3,360.15 a ton, the highest since Nov. 16.

Attachments

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

I

Dear Fellow Shareholder,

Update on Zinifex Offer

Since I last wrote to you, your Directors have continued to evaluate all options and strategies to maximise shareholder value, in light of the current inadequate offer from Zinifex.

With Zinifex’s extension of its offer you now have more time to consider your position and await further developments

With best personal regards

Tony Howland-Rose

MSc, DIC, FGS, FIMMM, FAusIMM, MAICD, FAIG, CEng

Chairman

Happyjack

Lol. With all those letters after his name, perhaps the chairman should run for president, or at least governor-general.

AGM "continued to evaluate all options and strategies to maximise shareholder value" - however when will he will specify and report on these "options and strategies" to shareholders?

On the one hand while the directors say shareholders should REJECT ZFX's offer, they should at the same time "consider (their) position and await further developments".

These statements come across as if not contradictory, at least cloudy and wafflish.

- Joined

- 4 February 2008

- Posts

- 158

- Reactions

- 0

Have been watching for quite some time after i got out at $16 after seeing rough seas ahead

Couldnt help myself after seeing the sp get smashed

Bought back in yesterday at 9.20 just in the nick of time by the look of it

Thinking on buying more in the early 9,s again

if she dives again

One would have to think ZFX would now have to be value at these prices ?

And now we have the bonus wild card

of chinese producers with the lights out he he !

he he !

Closed at 10.15 today

GO ZFX

Nice !

Couldnt help myself after seeing the sp get smashed

Bought back in yesterday at 9.20 just in the nick of time by the look of it

Thinking on buying more in the early 9,s again

if she dives again

One would have to think ZFX would now have to be value at these prices ?

And now we have the bonus wild card

of chinese producers with the lights out

Closed at 10.15 today

GO ZFX

Nice !

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

I used the rise today to sell down some higher cost parcels, I'm not far off from being spot on average - luckily got some at $8.50. Anything under $10 will be a target for me. Could see a little weakness with the Quarterly next week - and of course Zinc had a big run last night on the LME - which usually pulls back a little on the following day.

Let's see .....

Let's see .....

- Joined

- 25 August 2005

- Posts

- 124

- Reactions

- 0

Zinifex bid for Allegiance stumbles

February 22, 2008 - 7:43PM

The Takeovers Panel has made a declaration of unacceptable circumstances and final orders regarding Zinifex Ltd's $745 million hostile takeover bid for nickel miner Allegiance Mining NL.

Last week, the Takeovers Panel ordered Zinifex to halt the processing of acceptances, amid claims shareholders were misled.

Zinifex's original offer was scheduled to close at 1900 AEDT on February 8 but half an hour later, Zinifex's announcement that it had extended the $1 per share bid by a fortnight hit the Australian stock exchange website.

The Takeover Panels said Zinifex's letter advising shareholders that the offer had been extended was collected by Australia Post at about 1700 AEDT on February 8.

Allegiance had claimed that some of its shareholders - including five per cent shareholder Lion Selection Group Ltd - had accepted the offer, wrongly believing it was about to close or had already closed.

"The panel has made orders to the effect that Allegiance shareholders who accepted the offer after 5.00pm (Melbourne time) but before 7.30pm on 8 February 2008 have a right to apply to Zinifex to cancel their acceptance of the offer," the panel said in a statement.

"The panel considered that any acquisition of control over voting shares in Allegiance should take, and in this case should have taken, place in an informed market and shareholders should have enough information to consider the merits of the extension of the offer and reasonable time to consider it.

"At 5.00pm on February 8, 2008, Zinifex should have informed Allegiance so that Allegiance could notify its shareholders."

On Wednesday, Zinifex again extended the offer, this time until 1900 AEDT on March 7.

As of Wednesday, Zinifex had a 5.44 per cent stake in its target, including the share acceptances that Zinifex may wind up cancelling.

Zinifex releases its half year results on Monday.

Shares in Allegiance closed steady at $1.07, while shares in Zinifex finished 69 cents higher, or 7.29 per cent, at $10.15.

© 2008 AAP

February 22, 2008 - 7:43PM

The Takeovers Panel has made a declaration of unacceptable circumstances and final orders regarding Zinifex Ltd's $745 million hostile takeover bid for nickel miner Allegiance Mining NL.

Last week, the Takeovers Panel ordered Zinifex to halt the processing of acceptances, amid claims shareholders were misled.

Zinifex's original offer was scheduled to close at 1900 AEDT on February 8 but half an hour later, Zinifex's announcement that it had extended the $1 per share bid by a fortnight hit the Australian stock exchange website.

The Takeover Panels said Zinifex's letter advising shareholders that the offer had been extended was collected by Australia Post at about 1700 AEDT on February 8.

Allegiance had claimed that some of its shareholders - including five per cent shareholder Lion Selection Group Ltd - had accepted the offer, wrongly believing it was about to close or had already closed.

"The panel has made orders to the effect that Allegiance shareholders who accepted the offer after 5.00pm (Melbourne time) but before 7.30pm on 8 February 2008 have a right to apply to Zinifex to cancel their acceptance of the offer," the panel said in a statement.

"The panel considered that any acquisition of control over voting shares in Allegiance should take, and in this case should have taken, place in an informed market and shareholders should have enough information to consider the merits of the extension of the offer and reasonable time to consider it.

"At 5.00pm on February 8, 2008, Zinifex should have informed Allegiance so that Allegiance could notify its shareholders."

On Wednesday, Zinifex again extended the offer, this time until 1900 AEDT on March 7.

As of Wednesday, Zinifex had a 5.44 per cent stake in its target, including the share acceptances that Zinifex may wind up cancelling.

Zinifex releases its half year results on Monday.

Shares in Allegiance closed steady at $1.07, while shares in Zinifex finished 69 cents higher, or 7.29 per cent, at $10.15.

© 2008 AAP

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

I stumbled across this site: http://www.zinc.org/index.html whilst researching the stuff we are investing in. Nice site with some good reading on all things Zinc

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

What happened to Zinc overnight?

Is it common to have absolutely no price movement? Seems odd to have a 5% run the day before and dead flat last night.

Is it common to have absolutely no price movement? Seems odd to have a 5% run the day before and dead flat last night.

Similar threads

- Replies

- 30

- Views

- 7K